Dear Shareholder

We are pleased to update you on another solid twelve months for Bank of Queensland. While there is no doubt that 2018 has been a year of turmoil for the banking industry, at BOQ we have been focused on implementation of our strategy and ensuring the fundamentals of our business remain strong.

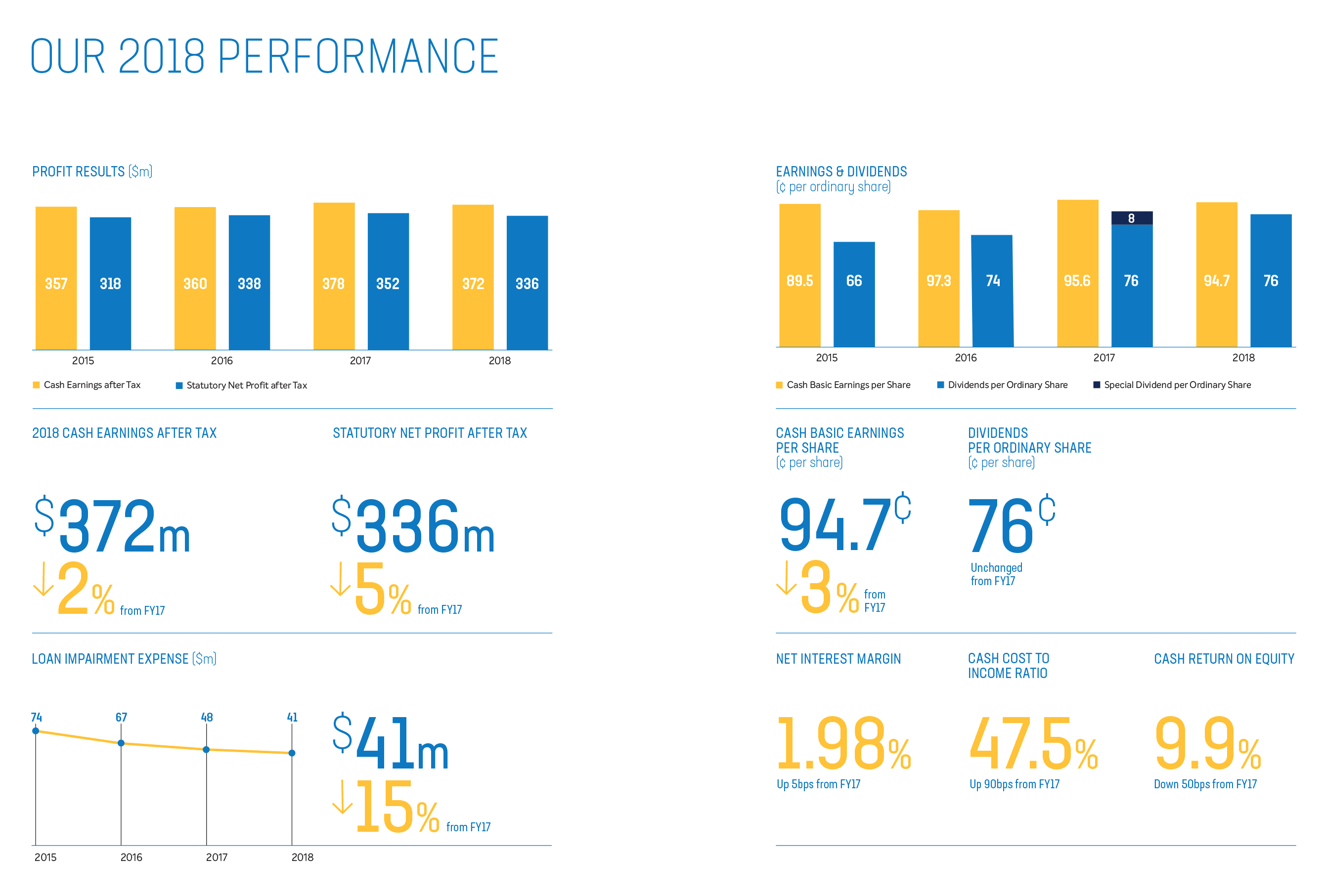

In terms of financial performance, we delivered cash earnings after tax of $372 million. This was a reduction of $6 million or two per cent on 2017. After adjusting for the $16 million one-off profit on the disposal of a vendor finance entity which occurred in 2017, the result was a three per cent increase on an underlying basis. The final ordinary dividend of 38 cents per share was maintained, taking the full year dividend to 76 cents per share.

The Group's balance sheet continued to grow with lending growth of $1.5 billion funded by an improved mix of deposits. The niche commercial lending segments, as well as housing loan growth in Virgin Money Australia and BOQ Specialist contributed strongly to this lending growth. The BOQ Finance business provided a solid contribution with growth of $250 million in its asset finance portfolio. Deposits were driven primarily through the branch network, which focused on encouraging more customers to make BOQ their main financial institution. Despite a number of margin headwinds emerging during the year, this supported an improvement in net interest margin to 1.98 per cent.

Operating expenses were well contained, while important investments in the business were made in line with the Group’s strategy. This included a new web experience platform which has delivered an improved digital experience to customers across all of our brands. Further work is underway on the modernisation of our technology architecture. We have also commenced development which will facilitate participation in the New Payments Platform, an industry initiative which will improve the experience for consumers making payments.

Asset quality metrics remain a key strength for BOQ. The ongoing improvements are a direct consequence of deliberate steps taken to clearly articulate risk appetite, lift risk capability and embed more stringent risk practices across the business. Impaired assets reduced by 15 per cent to $164 million, while loan impairment expense reduced 15 per cent to $41 million. Loan arrears remain at benign levels. Regulators have been focusing on responsible lending practices. We are pleased to report that BOQ has been ahead of the curve in this regard.

Our strong capital position has provided flexibility to consider a range of options for capital management. As a result, we have announced plans to increase our capital investment in 2019, with a focus on enhancements to our digital platforms and customer experience.

This investment in the future will provide a much needed boost to our customer offering and allow us to compete more effectively.

We announced the sale of the St Andrew’s Insurance business to Freedom Insurance Group in April 2018. The dynamics of the insurance market have changed significantly since the acquisition of St Andrew’s in 2010, and it was determined that a sale was the best outcome for shareholders as well as for the St Andrew’s business. This transaction is subject to regulatory approvals.

The banking sector has faced intense scrutiny in 2018. The number of inquiries, reviews and the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has highlighted how the sector has fallen short of meeting community expectations. Some of the findings that have emerged reflect poorly on the industry and has tested the reputation of all banks. In the case of BOQ, we have been increasing our focus on ensuring that ethical conduct is embedded in everything we do and when mistakes are made, we fix them.

Looking ahead, the operating environment remains challenging with ongoing scrutiny, regulatory change, slowing credit growth, technological change and higher funding costs all adding pressure to earnings growth.

We remain confident that we have the right strategy to navigate this environment and to continue delivering value for our stakeholders into the future.

We would like to thank all of our people and shareholders for your ongoing support and encourage you to review our annual reporting suite for more detail on what has been happening at BOQ in 2018.