BOQ Annual Reporting 2023

Annual Report

The Group’s Annual Report sets out the activities of the group during FY23, detailing our financial and non-financial performance and articulates how we aim to deliver long term value to our stakeholders. This includes our Financial Statements.

Sustainability Supplement

The Group’s Sustainability Supplement sets out the activities of the Group during financial year 2023, detailing sustainability topics not addressed in the Annual Report and relevant to a broad group of stakeholders such as our customers, employees, or communities.

Corporate Governance Statement

The Group's 2023 Corporate Governance Statement discloses how we have complied with the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations.

FY23 Investor Materials

The Group's FY23 Investor Materials provide a high-level overview of the BOQ Group’s performance, a detailed result analysis and a discussion on the outlook, which covers the macro environment and the Group’s high-level priorities.

FY23 was a challenging year for BOQ Group with an eight per cent decline in cash earnings, changes in leadership and identified weaknesses in our operational resilience and risk culture resulting in two Court Enforceable Undertakings.

Our performance was impacted by margin and inflationary headwinds and the following decisions we made, which compromised FY23 performance for longer term benefit.

In 2023 we:

- moderated growth in a highly competitive market,

- focused on delivering sufficient returns and supporting our existing customers,

- strengthened financial resilience and held higher liquidity,

- increased operational expenses, investing in our risk capability, customer experience and digital transformation; and

- took a goodwill impairment, a risk remediation provision and a restructuring charge, impacting our statutory profit.

Highlights for the year include the performance of our business bank, the delivery of all three retail brands onto the new digital banking platform for transaction and savings accounts, our strengthened financial resilience through increased capital and liquidity buffers and sound asset quality.

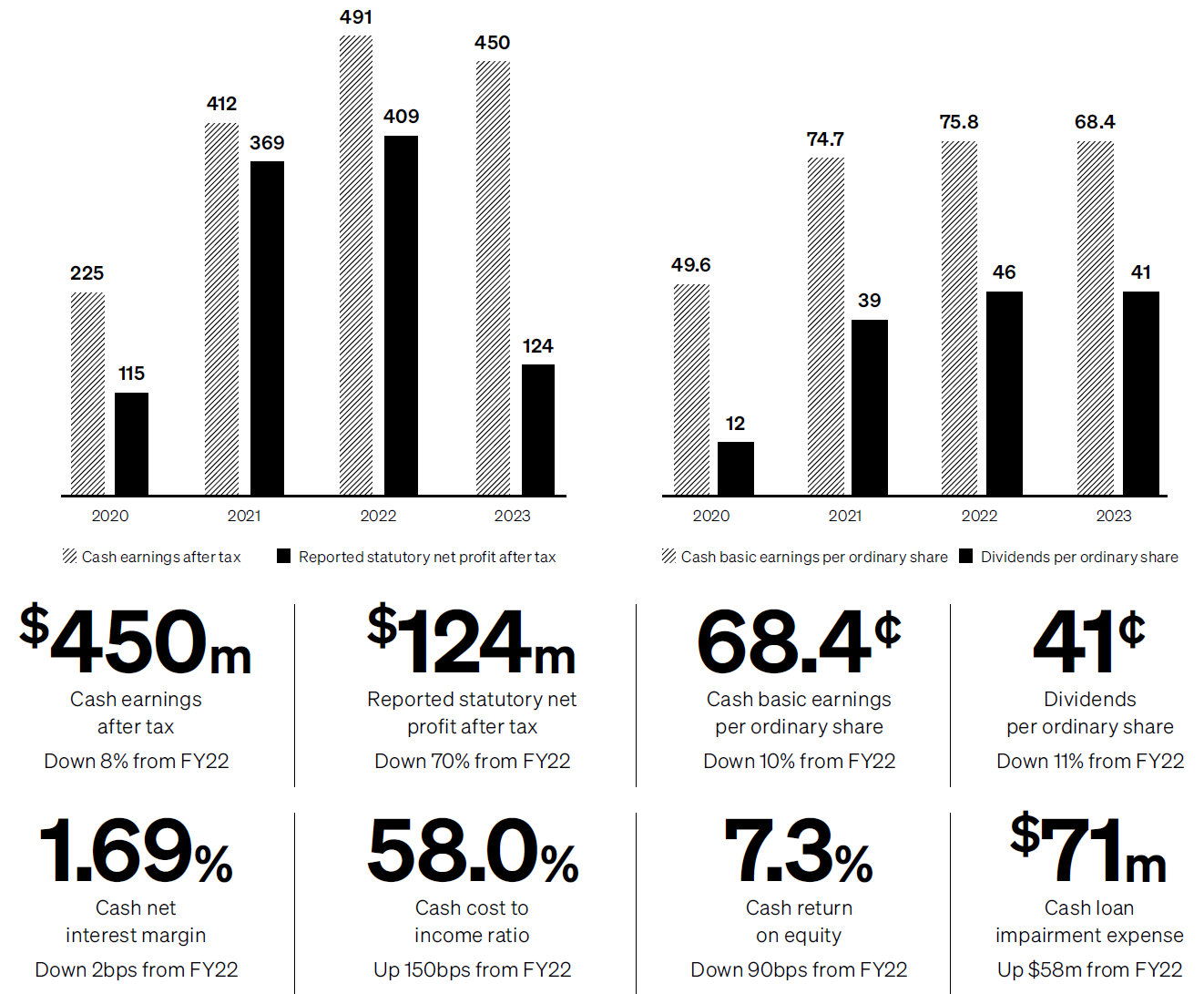

We delivered $450 million after tax cash earnings and $124 million statutory profit. The Board has determined to pay a 41 cents per share dividend, representing an approximate 7.1 per cent yield(1).

We acknowledge that the Court Enforceable Undertakings have eroded some of the trust our stakeholders have in us. We take accountability for this and have taken the following actions:

- made changes to the executive leadership team and taken consequence management decisions,

- shifted our strategic priorities to building a simpler and more resilient bank while continuing to digitise; and

- committed to remedial action plans to uplift our operational resilience, risk culture and Anti-Money Laundering/Counter-Terrorism Funding (AML/CTF) compliance.

Leadership Change and Consequence Management

Over the past year and a half, we have implemented leadership changes across all three lines of defence, including renewal of the Managing Director & Chief Executive Officer (CEO) and senior leaders in Finance, Operations (including Financial Crime Operations), Group Risk, Legal and Internal Audit. Recognising that BOQ required different capability, leadership style and focus, in November 2022 we commenced an executive search for a new CEO. Former Chairman Patrick Allaway was appointed as Executive Chairman to bring stability to the Group as the search progressed. In March 2023, Patrick was appointed as CEO and in August 2023 we announced that the search had been discontinued and Patrick would remain in the role. This decision was made considering the strength of leadership, clarity of goals and execution discipline that Patrick has brought to the business.

In addition to these leadership changes, the Board has taken the following consequence management actions, including:

- to reflect the Board’s collective accountability, in FY24, Non-executive Directors’ fees will be reduced by 20 per cent of the individual FY23 base fees paid,

- the CEO recommended that he forgo his FY23 Performance Shares; his recommendation was supported by the Board which had separately considered the matter and determined that it was an appropriate outcome,

- determining to lapse or forfeit all unvested and/or restricted equity retained by several former senior executives; and

- determining to lapse up to 100 per cent of FY23 Performance Shares and forfeit up to 100 percent of FY22 Performance Shares held by current or former executives.

We also reduced the size of our executive team during the year. The leadership team of eight people is now more appropriate for a bank of our size.

Strategic Priorities

The Group announced its digital transformation strategy in 2020, with a multi-year investment program to deliver a data led, digitally enabled bank. This strategy was designed to address our historical technology deficit from multiple years of under-investment, with the ambition of building a digital bank, uplifting customer experience, automating manual processes and lowering our cost to serve.

We are committed to this as part of our digitise strategy and have made considerable progress. All retail brands are now on the new digital platforms. We upgraded the business bank core banking platform, our banker technology and commenced migration of data centres to the cloud. As we progress, more of our legacy platforms and systems will be retired, reducing operational complexity and manual processes. In FY23 we decommissioned more than 10 per cent of our net technology asset portfolio. The next phase will be the launch of digital mortgages and acceleration of ME onto the end-to-end digital platform, decommissioning the ME legacy systems entirely..

Following the identification of operational risk weaknesses and the change in CEO, we announced we had shifted our priorities to building a stronger, simpler, digitally enabled bank, while optimising performance.

Our strengthen strategic pillar is focused on building stronger foundations, maintaining strong financial resilience and uplifting our operational resilience and risk culture through our remedial action plans.

Our simplify pillar is focused on reducing operational complexity, consolidating like activities through a shared service model, improving processes, reducing our property footprint and optimising vendor engagements to reduce costs, operational risk and cost of change.

Our optimise pillar is focused on addressing our structural challenges, seeking to diversify and lower our funding cost and improve our return on equity through prudent allocation of capital with appropriate returns.

Remedial Action Plans

Following the identification of risk weaknesses in our businessin 2022 and closely working with regulators, we conducted independent reviews and a root cause analysis. We commenced the planning for a multi-year scope of work to address these findings and uplift BOQ’s operational resilience and risk culture.

In April 2023 we announced a $60 million provision to fund these Remedial Action Plans(2). In subsequent discussions with APRA and AUSTRAC we agreed to enter two Court Enforceable Undertakings.

We recognise that we have material improvements to make and are using the Court Enforceable Undertakings as a platform to address our risk management and compliance weaknesses. We have scoped and submitted these remediation plans with our regulators and are committed to this multi-year program of work.

Exceptional Customer and People Experience

The success of our organisation relies on providing exceptional customer experience, supported by a diverse and highly engaged workforce. We aspire to be top three in Net Promoter Score once our digitisation is complete, and acknowledge we have more work to do.

As part of the leadership team changes we created a new role, Chief People and Customer Officer. This role has elevated the customer and people voice within the Group, ensuring we deliver exceptional outcomes for customers and support the retention and development of our people.

Our digital banking platform and contact centre aim to deliver a significantly improved customer experience. We continue to work on stability, performance and providing customers a seamless experience.

Increased cost of living combined with one of the sharpest interest rate tightening cycles in recent history has resulted in a challenging year for many Australians. While this impacted household budgets and businesses, our lending portfolio is well placed to withstand current pressures, and we continue to support customers through a range of measures.

Australia has experienced a material increase in fraud and scams in FY23 through increasingly sophisticated criminals taking advantage of digital banking and real time payments. We are continuing to support customers impacted by this criminal activity through increased education and ensuring their digital devices are secure.

We enhanced our people experience this year with the successful consolidation of two enterprise agreements across heritage BOQ and ME employees. The new agreement provides for guaranteed salary increases and attractive employee benefits, balanced with the ongoing financial needs of the Group.

Building Social Capital through Banking

Our purpose of Building Social Capital through Banking is what we stand behind, creating the best people and customer experience, living our values, celebrating diversity and inclusion, contributing to communities, being a good corporate citizen and playing our part in Australia’s transition to a low carbon economy.

We are on track to achieve 100 per cent renewable electricity by 2025, with 84 per cent renewables consumed this financial year. We have maintained our Climate Active carbon neutral certification and are well progressed in delivering a reduction of 90 per cent in Scope 1 and 2 emissions by 2030(3).

This year we supported nine community partners in delivering key services to Australians, proudly investing $2.2 million at Group and grassroots levels.

In an Australian market first, ME Go customers have the option to select from five charity-linked debit cards, each providing a one cent donation per digital wallet transaction. These donations, paid by the Group, allow customers to align with a charity and is one way we Build Social Capital Through Banking.

Launching our second Innovate Reconciliation Action Plan in April 2023 was also a proud moment, reflecting our ongoing commitment to its vision of ‘an Australia in which First Nations peoples have infinite opportunity and prosperity’.

Outlook

While this year has seen challenges, we are proud of what we delivered. The transformation to a digital, agile and low-cost bank is progressing at pace. Your bank is in a strong financial position to support customers and enable continued investment in our transformation. Your Board and executive team are confident that our strategy will result in a bank that is unique, optimised and ready to meet the ever-evolving needs of our customers while delivering sustainable returns to our shareholders.

We acknowledge the hard work of our people, who demonstrate unwavering passion for serving our customers every day. On behalf of the Board and executive team, we sincerely thank our people for their dedication, in a year that has seen significant change and challenge.

Thank you to our shareholders for your continued support.

Patrick Allaway Warwick Negus

Managing Director & CEO Chairman

(1) Yield at closing share price of $5.76 as at 31 August 2023.

(2) Previously called Integrated Risk Program.

(3) Against a 2020 baseline.