BOQ Annual Reporting 2024

Download PDF

Annual Report

The Group’s Annual Report sets out the activities of the group during FY24, detailing our financial and non-financial performance, it articulates how we aim to deliver long term value to our stakeholders and outlines our performance against social, environmental and economic challenges and opportunities.

This reporting includes our:

- Corporate Governance Statement

- Sustainability Report

- Remuneration Report

- Financial Statements

Download Data Pack

Sustainability Data Pack

The Group’s Sustainability Data Pack provides further detail on our Environmental, Social and Governance performance.

Download PDF

Investor Materials

The Group’s Investor Materials provide a high-level overview of the Group's performance against its strategy, environmental and social commitments, a detailed financial result analysis and a discussion on the outlook, which covers them macro environment, and the Group's high-level priorities.

This year marked 150 years of BOQ supporting Australia through serving our community, funding the growth aspirations of small and medium businesses, and helping households achieve their home ownership and savings goals.

Our strong history has been celebrated, and your Board and management has remained firmly focused on the future. This has been a year that has been pivotal in resetting the Group for future success, we are undertaking a cultural and capability transformation, with significant progress made against our four strategic pillars.

We have built real momentum in digitising the bank, with the retail digital bank now largely delivered, and are substantially simplifying our operating model and distribution channels. Through disciplined execution of our plans, we are laying the foundations for a simpler, specialist bank that will enhance the experience for both our customers and people, and provide sustainable returns for our shareholders.

The financial landscape remained challenging during FY24 as lending margin compression in home loans continued and the refinancing of the term funding facility increased competition for deposits.

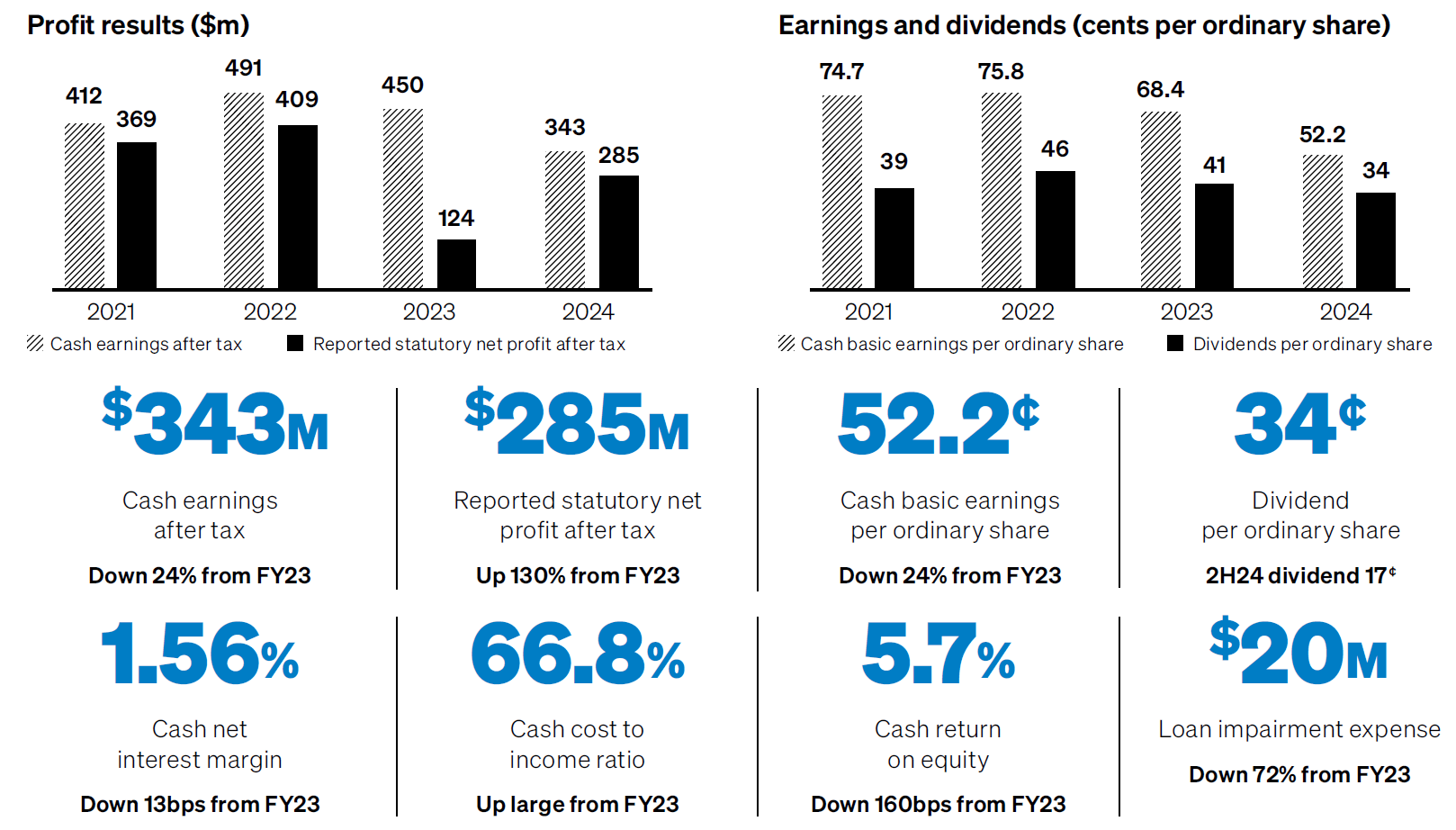

We delivered after tax cash earnings of $343 million, and $285 million in statutory profit for the year. The Board has determined to pay a dividend of 17 cents per share, representing a yield of approximately 5.4 per cent.(1)

The strength of our balance sheet and continued financial resilience has allowed us to support Australian families and businesses who have faced cost of living pressures on the back of increased cash rates and persistent inflationary burdens. We recognise there are lagged and sustained impacts for some households and businesses. Our dedicated team provided financial difficulty assistance to 3,574 customers through the year.

Digital progress and simplifying distribution channels

Customer preferences continue to evolve. We know that more than 99 per cent of total banking industry customer interactions are now made via online banking and apps(2), and we are adapting our business model to support the growing demand for digital banking. The vastly improved customer experience(3) on our new digital banking apps, as compared to the legacy experience, is evidence of our digital transformation.

Approximately one in every four of our retail deposit and credit card customers are already enjoying this enhanced digital experience. ME customer migration commenced this year, and we are excited that more customers will soon be able to complete their banking on this new platform as we continue the planned migration of customers.

This year, we successfully piloted our much-anticipated digital mortgage, marking a significant milestone in our digitisation journey. The digital mortgage platform positions us to expand our home loan offering in a highly commoditised market, reducing costs and enabling us to scale at pace. Most importantly, it ensures a seamless and fast process for our customers, from application through to funding.

The strong progress in digitising BOQ has allowed us to deeply consider the pathway as we continue our transformation to a simpler, specialist bank.

One aspect of this transformation is to simplify our distribution channels and pivot the mix of revenues towards business banking target segments, where we have competitive advantages and strong customer relationships.

Our unique Owner Managed model has served the Group well, historically. However, in the contemporary retail banking environment, and consistent with BOQ's digital transformation, difficult decisions were required to be made.

In August 2024, we announced that we will be converting all 114 Owner Managed Branches to corporate branches. This is a fundamental change to the way we operate. This decision will allow the Group greater control and flexibility to manage our digital and relationship banking model, and continue to meet the evolving preferences of our customers in how they manage their banking needs.

Our Owner Managers have enormously contributed to the history of the Group. We express our sincere gratitude for them and the commitment they have shown to BOQ's customers and their communities.

Risk culture and management

As we close out the first full year of our Court Enforceable Undertakings (CEUs) with APRA and AUSTRAC, we have progressed against our agreed remedial action plans, monitored by our independent reviewers. We have embraced these CEUs as a platform for foundational and sustainable uplifting of risk management and are pleased with the progress that has been made. Our bi-annual people pulse survey, which was most recently conducted in August 2024, showed significant improvement in key cultural focus areas which are in line with our target state. People feeling safe to speak up was measured at 82 per cent, which is an increase from 76 per cent at August 2022, prior to the commencement of our risk programs.

Scams and fraud

The prevalence of scams and fraud remains a key issue across the financial services sector, with more than 601,000 scam reports made by Australians in 2023(4). BOQ Group has partnered with the Australian Banking Association’s Scam-Safe Accord and are committed to a whole-of-industry approach.

In 2024, we protected our customers from more scams than ever, stopping $9 million(5) in losses to customers from scams, through continued investment in technologies and providing increased awareness to customers.

Partnering in the community

We are pleased to continue supporting three key long-term community partners who make a significant contribution to vulnerable Australians.

In July each year, BOQ Group “turns” orange to raise awareness and funds for Orange Sky Australia. This year $205,000 was raised in this campaign alone, and importantly our people have been increasingly able to engage in volunteering and awareness activities.

Increasing financial resilience and community connection remains a cornerstone of our partnerships with STARS and Clontarf. This year we extended our financial literacy games to add ‘Pay Me Later, Pals’ along with existing ‘Budget Like a Boss’ games and delivered these programs to over 300 First Nations teenagers.

Our commitment to the environment

The Group recognises the role we play as Australia transitions to a lower carbon economy. We have previously set emissions targets, to reduce Scope 1 and 2 by 90 per cent, and Scope 3 by 40 per cent, against a 2020 baseline.

In recognition of recent legislative changes and to ensure we are aligned with global best practice while supporting our customers in the transition to a lower carbon economy, BOQ has joined the Net Zero Banking Alliance and became a signatory to UNEP FI’s Principles for Responsible Banking (6).

As we implement the framework, adopt guidance and prepare for mandatory climate-related financial disclosure requirements in 2025, we will establish new science-based targets for operational and financed greenhouse gas emissions.

Board and management

In February 2024, we welcomed Andrew Fraser as an independent Non-Executive Director to the BOQ Board, bringing a wealth of experience across government, sports, superannuation, construction and education.

As announced to the ASX, BOQ is pleased to welcome Mary Waldron as a new director to BOQ on 11 November 2024 and thanks both Bruce Carter AO and Dr Jennifer Fagg for their service on the BOQ Board. The Board is very grateful for the contributions of Mr Carter noting his over ten years’ of service including as the Chair of the Risk Committee and Dr Fagg’s contributions since 2021.

Throughout the year, we welcomed Rachel Stock as Chief Risk Officer, a seasoned financial services risk leader with a depth of experience in governance, risk management and operations, and Alexandra Taylor as Chief People Officer, a proven commercial transformation leader, who has developed and executed high-impact human resources strategies to advance business objectives.

Exceptional customer and people experience

Underpinning all that we do, is our unwavering focus on our customer experience, and the dedication and commitment of our people.

Part of our transformation is progressing towards our target state culture. Whilst we have seen a steady People Experience Engagement Index over the past year at 71 per cent, we recognise there is more work to do.

Pleasingly, we have seen an increase in our people’s experience in respect of accountability, conflict management, collaboration and career development. Importantly, we saw an increase to 82 per cent of our people knowing what they need to do to deliver our strategy.

Outlook

While the Australian economy has been subdued with persistent inflation, low productivity and global uncertainty, we are more optimistic about the outlook given continued low unemployment and supportive fiscal policies.

The strategic decisions we have made will position the Group to scale our Retail Bank at a lower cost to serve and grow higher[1]returning assets, leveraging the strength of our specialist Business Bank. We have a clear plan and are committed to delivering a simpler and specialist BOQ, providing stronger outcomes for our customers, our people and attractive returns to our shareholders.

We thank our shareholders for their ongoing support, and our people for their dedication and commitment to shaping the future of BOQ.

Sincerely,

Warwick Negus Patrick Allaway

Chair Managing Director & CEO

(1) Yield calculated on 30 August 2024 share price of $6.32.

(2) ABA, Bank On It: Customer Trends 2024.

(3) App ratings as at 23 September 2024: myBOQ 4.5; VMA 4.4; ME Go 4.5; BOQ (Legacy) 1.2 stars, from five.

(4) ACCC, Targeting scams: Report of the ACCC on scams activity 2023 (April 2024)(5) Internal metric.

(6) The signing of UNEP FI's Principles for Responsible Banking occurred post balance date.