April 2024 – Deepfake AI Scams

BOQ have been alerted to an emerging scam type which utilises artificial intelligence (AI) through deepfakes. Deepfakes are categorised as lifelike impersonations of real people created by AI. Deepfakes are capable of closely imitating one’s likeness and in some cases, can mimic a person’s voice and body language. Unfortunately, scammers are using AI to create fake news articles and videos impersonating well-known individuals (e.g. Hugh Jackman, Gina Rinehart, Elon Musk) and businesses to attract customers to ‘take advantage’ of fake investment opportunities.

These articles or videos will typically show the public figure in an interview-style setting speaking about fake trading platforms and may show them using the fake platform to feign credibility. The platforms may claim to use AI and other technologies that can create high profit margins for those willing to invest. While these scams typically begin with a request for a small fee to access the platform, over time they have the propensity to generate significant financial loss.

It is important to always be on alert for potential scams online. Here is what to look out for with deepfake AI scams:

- Videos or articles of public figures promoting trading companies or investment platforms

- Most celebrities and public figures will not use or have the need to use investment platforms. It is important to always do your own due diligence and research into investment companies prior to investing.

- Refrain from clicking any links or contacting provided details attached to these articles/videos

- These scams use third-party links which can lead you to fake investment platforms where your personal details can be compromised. Never click third-party links or provide card/account information.

- Avoid any investment opportunities that seem ‘too good to miss out on'

- Perpetrators use ‘high return’ as a strategy to lure individuals into using their platform over other trading platforms. Safety is key, unfortunately ‘higher’ is not always better!

When investing, it is important to remain vigilant and seek independent financial advice prior to proceeding. Due to the high volume of scams in this area, it is crucial to conduct your due diligence and research.

If you have any concerns about the legitimacy of an investment opportunity or trading platform, you can contact us directly (either via financialcrimes@boq.com.au or using the details on our https://www.boq.com.au/contact-us page).

March 2024 – BOQ Term Deposit Scam

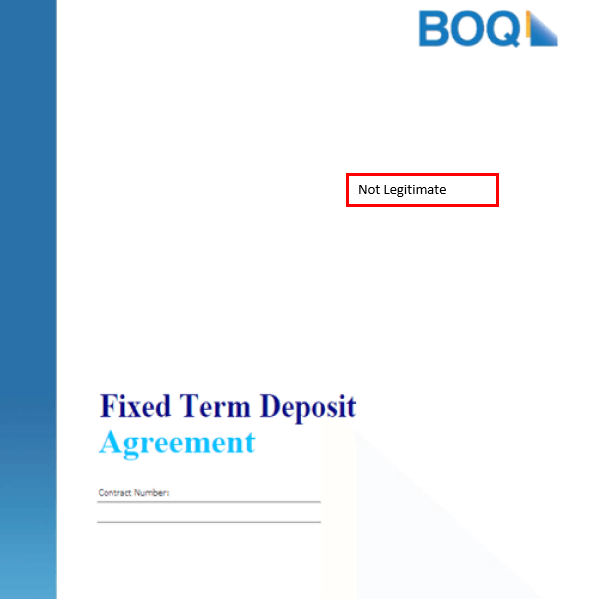

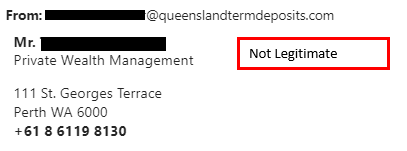

The Bank has been made aware of a BOQ branded Term Deposit scam which has adopted the name of a genuine BOQ employee to impersonate for this scam.

Customers have reported to being contacted by someone claiming to be a Private Wealth Manger at 111 St. Gorges Terrace WA 6000. Customers have reported that they were contacted via phone and email to discuss the opportunity and received brochures offering BOQ Term Deposits with unusually high interest rates of up to 7.30% per annum.

Investors may be targeted whilst browsing the internet looking for a good rate, or from completing enquiry forms, via some third-party or comparison sites.

The imposter reportedly initiates and maintains contact via phone and email. During this time, they may provide seemingly official documentation and forms with application documents, maturity dates, and terms and conditions surrounding possible investment options.

What to look out for:

- Unrealistically high returns or bonds which seem ‘too good to be true’.

- Consistent pressure to invest due to the ‘risk of missing out’.

- Professional looking forms or prospectuses with either:

- ‘lookalike’ email addresses (e.g. @queenslandtermdeposits.com)

- non-genuine phone numbers (e.g. +61 8 6119 8130)

- Unusual requests for personal information and extensive ID documents.

- Being asked to pay funds directly into a bank account with BSB’s not belonging to BOQ.

If you have any concerns about the legitimacy of correspondence, please seek independent financial advice or contact us directly (either via financialcrimes@boq.com.au or using the details on our https://www.boq.com.au/contact-us page).

Helpful Links and Resources:

February 2024 - B.Q.L Management Pty Ltd Scam

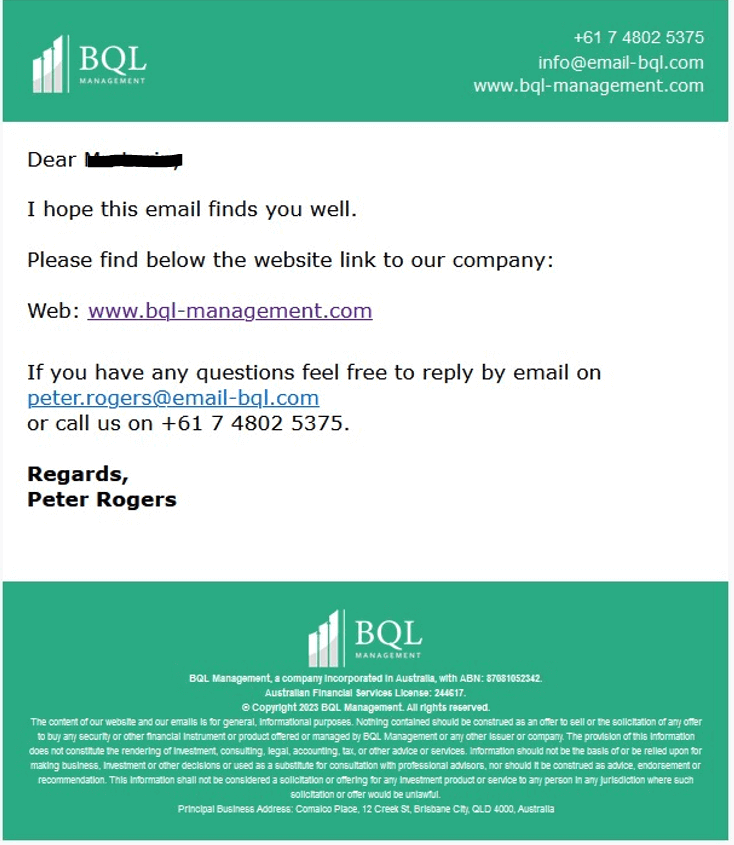

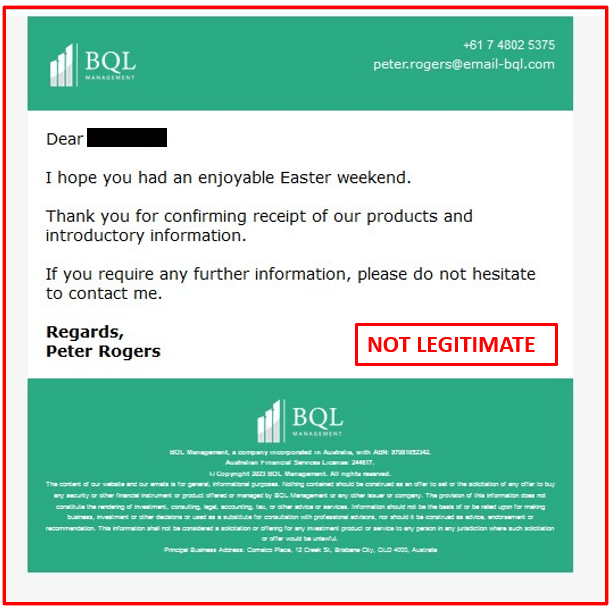

We are aware of a new B.Q.L Management Pty Ltd branded imposter term deposit and bonds scam. Scammers are claiming to be selling Bond and Term Deposits via a scam wesbite "www.bql-management.com".

The imposter reportedly initiates and maintains contact via phone and email. During this time they may provide seemingly official documentation and forms with application documents, maturity dates, and terms and conditions surrounding possible investment options.

What to look out for:

- Unrealistically high returns or bonds which seem ‘too good to be true’.

- Any mention of a ‘guaranteed fixed income’ or ‘no exposure’.

- Consistent pressure to invest due to the ‘risk of missing out’.

- Professional looking forms or prospectuses with either:

- ‘lookalike’ email addresses (e.g., info@email-bql.com)

- non-genuine phone numbers (e.g., (07) 4802 5376)

- formatting inconsistencies

- Unusual requests for personal information or copies of identity documentation (e.g., Driver’s Licence or Passport).

- Being asked to deposit funds directly into a bank account.

If you have any concerns about the legitimacy of correspondence, please seek independent financial advice or contact us directly (either via financialcrimes@boq.com.au or using the details on our https://www.boq.com.au/contact-us page).

Helpful Links and Resources:

January 2024 - Investment Scam Warning

BOQ is aware of a high volume of investment scams currently circulating in Australia and targeting our customers. Investment scams are schemes that promise high returns or low risks but are designed to take your money and run. They often use fake websites, documents, and testimonials to lure you in and make you believe they are legitimate.

It is important to know that any business who provides a cryptocurrency exchange in Australia must be registered with AUSTRAC. One example of a currency exchange which has had their registration with AUSTRAC suspended is Bluestar Exchange Pty Ltd, a company that claims to offer foreign exchange trading services (current at 17/11/2023). AUSTRAC have issued warnings about unregistered digital currency exchanges and advised investors should avoid dealing with them. If you have invested with an unregistered exchange, you should contact BOQ immediately.

To avoid falling victim to investment scams, you should always do your own research and check the credentials of any company or person you are dealing with. Here are some warning signs to look out for:

The offer sounds too good to be true, such as guaranteed or unrealistic returns, low or no fees, or exclusive access to a secret or insider deal.

- The offer sounds too good to be true, such as guaranteed or unrealistic returns, low or no fees, or exclusive access to a secret or insider deal.

- The offer is urgent or pressure-filled, meaning you are asked to act quickly or miss out on a limited opportunity, or you are not given enough time or information to make an informed decision.

- The offer is complex or confusing, meaning you are not given clear or consistent details about how the investment works, what the risks are, or how you can get your money back.

- The offer is unregulated or unregistered, meaning the company or person is not licensed or authorised by AUSTRAC, ASIC or any other reputable regulator, or the investment product is not registered or disclosed on any official platform.

If you suspect that you have encountered an investment scam, you should take the following steps:

- Do not respond to or engage with the scammer, and do not provide any personal or financial information.

- Stop any payments or transfers you have made or are about to make and contact your bank or financial institution as soon as possible.

- Report the scam to ASIC, the ACCC, AUSTRAC or Scamwatch, and provide as much evidence as you can.

- Seek professional advice from a licensed financial planner or counsellor if you need help with your financial situation or recovery.

At BOQ, we care about your financial security and well-being. We are committed to helping you protect yourself from fraud and scams. If you have any questions or concerns, please contact us on 1300 55 72 72 or visit our website for more information and tips.

November 2023 – Online Shopping Scams

We're approaching the busiest time of year for online shopping with Black Friday, Cyber Monday and Boxing Day sales almost here. We're warning customers to to be alert to scam websites or text messages when shopping online for bargains.

Shopping scams remain a significant threat, exposing individuals and businesses to risks through fake product listings, deceptive payment requests, and insecure payment avenues.

Your financial security is our top priority, Identifying the collection of personally identifiable information, especially card details during this season, heightens the risk, leaving individuals and businesses vulnerable to data-hungry cybercriminals.

What to look out for:

- Requests for payments via bank transfer or virtual currencies.

- Links in emails soliciting bank details or other sensitive information.

- Requests to charge an application or priotity fee or for multiple forms of personal identification including your bank details.

- Emails and messages regarding undelivered items or fees required for a 'failed' delivery.

- Inadequate information on privacy, conditions of use, dispute resolution, or contact details.

Shopping online securely:

- Safeguard payment information and accounts; refrain from saving payment details on online shopping accounts.

- Trust reputable sellers.

- Be aware of warning signs.

- Be aware of advertisements on social media - always google the company and validate the sale on their website.

If you receive suspicious emails or messages, refrain from clicking any links or providing card details. Exercise caution with online shopping deals; if it seems too good to be true, it probably is!

If in doubt, contact BOQ:

- To report a fraud or scam, attend your local branch or call us immediately on 1300 55 72 72 (Monday-Friday, 8am-8pm AEDT, and Saturday 9am-5pm AEDT).

- Report a cybercrime or cyber security incident to the ACSC via ReportCyber at www.cyber.gov.au/report, or call the Australian Cyber Security Hotline on 1300 CYBER! (1300 292 371).

September 2023 – BOQ Impersonation Scam

BOQ are aware of a new fraud trend where customers are receiving phone calls from UK based third parties claiming to be representatives of the bank.

During these calls, scammers will pose as employees from Bank of Queensland and attempt to gain a large amount of personal information from you, often including full legal name, Internet Banking log in information, Visa card numbers, date of birth and one-time verification codes.

Using this information gained from you, the scammers will then use a number of techniques to gain access to your funds.

The scammers may attempt to:

- Complete fraudulent charges on your card by adding your card number to their digital wallet

- Pose to be you in order to make changes to your banking profile including increasing daily limits, resetting your Internet Banking password or changing your contact details

- Log in to your Internet Banking profile to access your funds

What to look out for:

- Unsolicited calls, emails or text messages claiming to be from BOQ (remember scammers can mask what number they are contacting you from and whilst it may appear to be genuinely from BOQ it could still be fraudulent)

- Requests for sensitive information from someone claiming to be BOQ

- Urgent or threatening language

- Communication with grammar or spelling errors

How to protect yourself:

- If you receive an unexpected call from someone claiming to be BOQ or another authority, hang up the call immediately and call the organisation back via a trusted phone number.

- Never disclose personal information and card numbers or other banking information on an unsolicited phone call.

- If you receive any suspicious correspondence, stop and call BOQ immediately to confirm if it is genuine.

If in doubt, contact BOQ:

- To report a fraud or scam, attend your local branch or call us immediately on 1300 55 72 72 (Monday-Friday, 8am-8pm AEDT, and Saturday 9am-5pm AEDT).

- Report a cybercrime or cyber security incident to the ACSC via ReportCyber at www.cyber.gov.au/report, or call the Australian Cyber Security Hotline on 1300 CYBER! (1300 292 371).

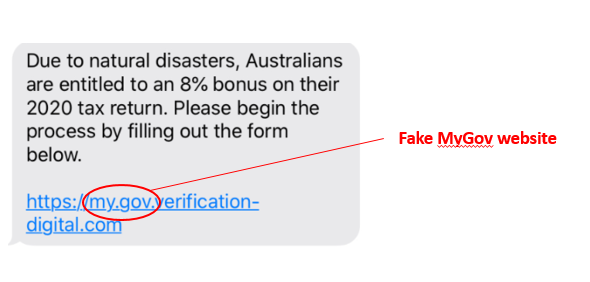

June 2023 – Tax Scams

In the lead up to End of Financial Year and tax return time, it’s time to be alert to the behaviour of scammers and to remain vigilant with personal information.

There are several tactics scammers use at this time of year in attempt to gain access to personal and/or account information. The most common technique is via an impersonation scam, where the scammer poses as the ATO, your bank or other trustworthy organisations.

Techniques scammers are using include:

- Scammers are posing as the ATO on social media offering help and advice on issues relating to tax and superannuation, to disguise what is actually an attempt to trick you into providing your information. The ATO will never ask for personal information via social media, email or SMS.

- Correspondence is circulating from scammers that tell you that you are entitled to a refund owing from the ATO. Like the above this is a disguise to trick you into providing personal information via the return forms.

- Scammers may also contact you to tell you that you have a tax debt that needs to be paid immediately. This may come with threats of arrest if payment is not made or ask for unusual payment methods such as gift card payments or payments made to personal bank accounts.

What to look out for:

- Unsolicited calls, emails or text messages from trusted sources such as the ATO, your super fund or your bank

- Communication via unofficial email addresses or phone numbers not related to the organisation.

- Communication with grammar or spelling errors

- Urgent or threatening language

- Emails with blurry or low-quality logos

- Unusual requests for sensitive information

How to protect yourself:

- Delete any suspicious correspondence from your account or block the account on social media.

- Never send personal information via social media, email or SMS.

- Never click on or log onto your government accounts via links in emails or text messages. Instead use logins provided on legitimate webpages.

- If you receive any suspicious correspondence stop and call 1800 008 540 to check if it was the ATO speaking with you.

If in doubt, contact BOQ:

To report a fraud or scam, attend your local branch or call us immediately on 1300 55 72 72 (Monday-Friday, 8am-8pm AEDT, and Saturday 9am-5pm AEDT).

If you have any concerns about the legitimacy of correspondence, or individuals, contact the ATO directly using their genuine website and contact details (https://www.ato.gov.au/). Alternatively if you’re unsure you can contact BOQ group directly (either via financialcrimes@boq.com.au or using the details on our Contact Us page).

Report a cybercrime or cyber security incident to the ACSC via ReportCyber at www.cyber.gov.au/report, or call the Australian Cyber Security Hotline on 1300 CYBER! (1300 292 371).

For more tips and resources, visit: https://www.boq.com.au/help-and-support/fraud-and-scams

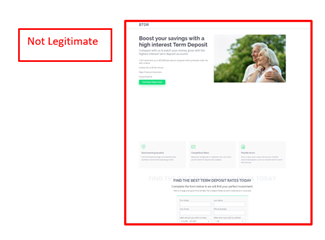

May 2023 - BOQ Term Deposit Scam

We have been made aware of a BOQ branded imposter term deposit scam, similar to a VMA branded imposter bond scam in January 2023. Scammers are attempting to adopt the identities of legitimate BOQ Group employees and are claiming to be selling Bond and Term Deposits of 4% - 6% with a minimum investment of $25,000.00.

Investors may be targeted whilst browsing the internet looking for a good rate, or from completing enquiry forms, via some third-party or comparison sites.

The imposter reportedly initiates and maintains contact via phone and email. During this time they may provide seemingly official documentation and forms with application documents, maturity dates, and terms and conditions surrounding possible investment options.

Offers for investment may appear branded across any of the BOQ Group brands including ME Bank, VMA, BOQ and MyBOQ.

What to look out for:

- Unrealistically high returns or bonds which seem ‘too good to be true’.

- Any mention of a ‘guaranteed fixed income’ or ‘no exposure’.

- Consistent pressure to invest due to the ‘risk of missing out’.

- Professional looking forms or prospectuses with either:

- ‘lookalike’ email addresses (e.g., name@boq-im.com, info@boq-applications.com)

- non-genuine phone numbers (e.g., (02) 9071 7190, 02 9191 7412)

- formatting inconsistencies

- Unusual requests for personal information or copies of identity documentation (e.g., Driver’s Licence or Passport).

- Being asked to deposit funds directly into a bank account.

If you have any concerns about the legitimacy of correspondence, please seek independent financial advice or contact us directly (either via financialcrimes@boq.com.au or using the details on our https://www.boq.com.au/contact-us page).

Helpful Links and Resources:

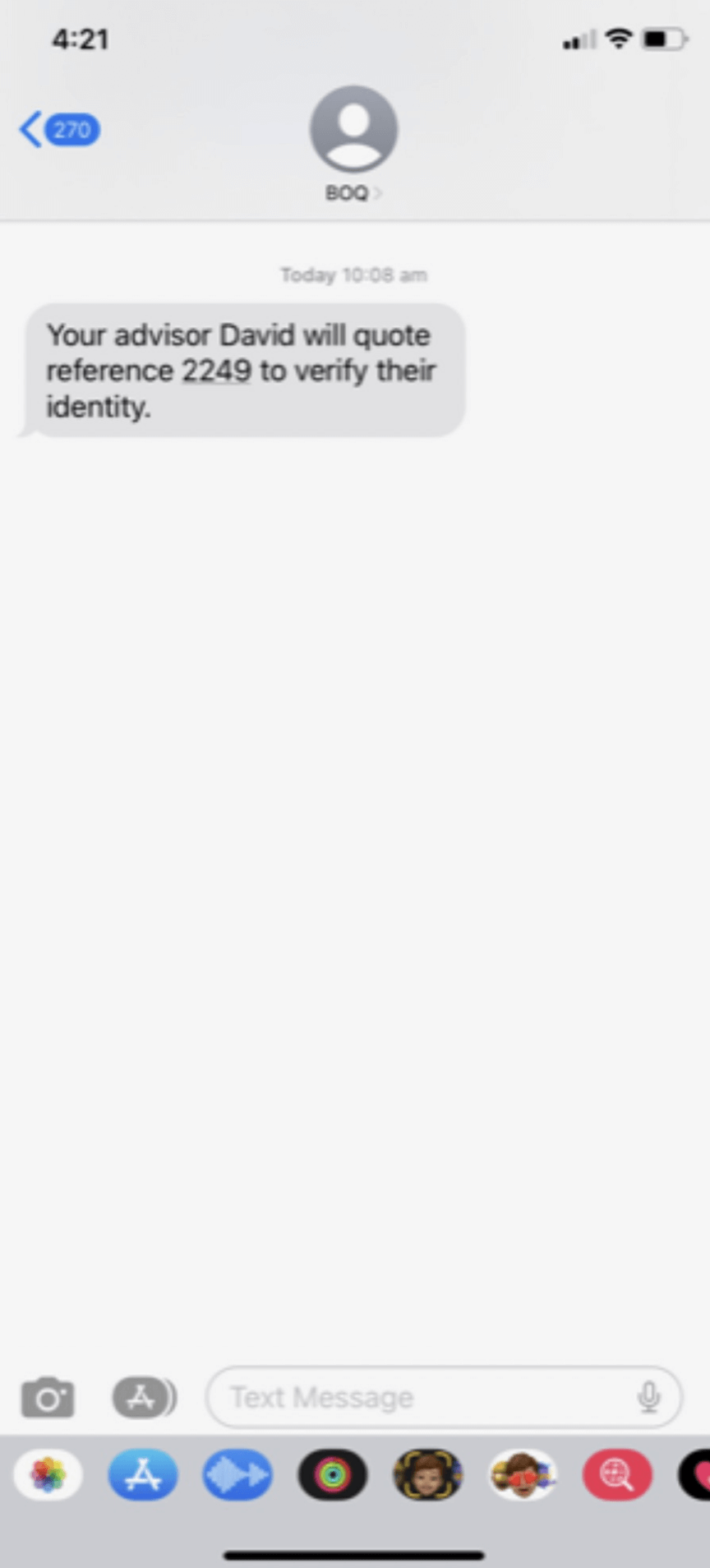

April 2023 - BOQ Group Impersonation and Phishing Messages

BOQ Group has been alerted to a new scam trend involving customers receiving text messages claiming to be from BOQ. These messages are appearing in the same chain as previous legitimate BOQ correspondence and may include spoofed links and names to appear legitimate. The message advises you that you will receive a phone call from BOQ staff regarding security concerns on the account. An authentication code is also included in the text message to quote to the caller.

Customers are then receiving a follow-up phone call from a third party posing to be from BOQ. The callers may then advise you that that your funds are not safe, and that they need to be transferred out of the your account to a “safe” account.

The caller may ask you to download remote access software onto your computer or mobile device and log into your Internet Banking.

What to look out for:

- Urgency is emphasised so that the scammers can pressure you to provide your details or convinve you to do something quickly.

- The text message or caller may allude to a security compromise with your account but may struggle to provide any specific information.

- Callers informing you that your funds are not safe.

- Callers asking for personal information or to transfer money over the phone.

How to protect yourself:

- If you receive an unexpected call or SMS, you should never click any links or provide any personal information.

- Always use the trusted applications and website to login to banking platforms.

- Never provide remote access to your device or PC.

- If directed to call your bank, always contact BOQ via a phone number or other details on our Contact Us page.

- If you think your account details or card details have been disclosed to a scammer, or if you receive a verification code that you didn't request, immediately contact BOQ on 1300 55 72 72 or you can also let us know by emailing financialcrimes@boq.com.au or by visiting your nearest branch.

March 2023 - Undercover Police/ Cash Withdrawal Scam

BOQ are aware that a higher influx of calls to customers requesting cash withdrawals where the callers are pretending to be representatives of the Undercover Police. The callers are targeting the elderly and vulnerable, claiming that the police are working on an operation to stop a hacker inside of BOQ from stealing your money. They introduce themselves with an alias, badge/staff number and fake reference number.

The caller claims that no money will be lost as it will be re-deposited later, whilst another party pretends to be a staff member to gain your personal details including address. These callers coach you into withdrawing cash from a BOQ branch, and provide a cover story (e.g., travelling overseas, work done on the house, and terminal illness related bills).

The scammers create layers of information, fabricate scenarios and individuals to create the illusion of a sophisticated sting operation. The secret nature of the operation is reinforced by convincing you to not tell friends, family or even the Bank.

After acquiring the cash, the scammers visit your address with a duffle bag to collect the cash and then disappear.

What to look out for:

- Unsolicited and unexpected phone calls from individuals claiming to be ‘undercover police’,

- Urgency and pressure to comply with the callers demands,

- Trusted organisations like the police will never ask for payment or for members of the public to assist in police operations. Take note of the name and badge number of the officer and contact your local police station to let them know.

How to protect yourself:

- Do not disclose personal information in an unsolicited or unexpected phone call,

- Never send or give money to someone you haven’t met in person,

- End the phone call if the caller is threatening or forcing you to do something (like withdraw cash),

- If you’re felling unsure, speak to a trusted family member, friend or your bank.

BOQ urge the community to remain aware and vigilant to these types of scams. If you do receive a request similar to this, contact the police and your bank immediately.

If in doubt, contact BOQ:

To report a fraud or scam, attend your local branch or call us immediately on 1300 55 72 72 (Monday-Friday, 8am-8pm AEDT, and Saturday 9am-5pm AEDT).

If you have any concerns about the legitimacy of correspondence, or individuals, contact us directly (either via financialcrimes@boq.com.au or using the details on our Contact Us page).

Report a cybercrime or cyber security incident to the ACSC via ReportCyber at www.cyber.gov.au/report, or call the Australian Cyber Security Hotline on 1300 CYBER! (1300 292 371).

For more tips and resources, visit: https://www.boq.com.au/help-and-support/fraud-and-scams

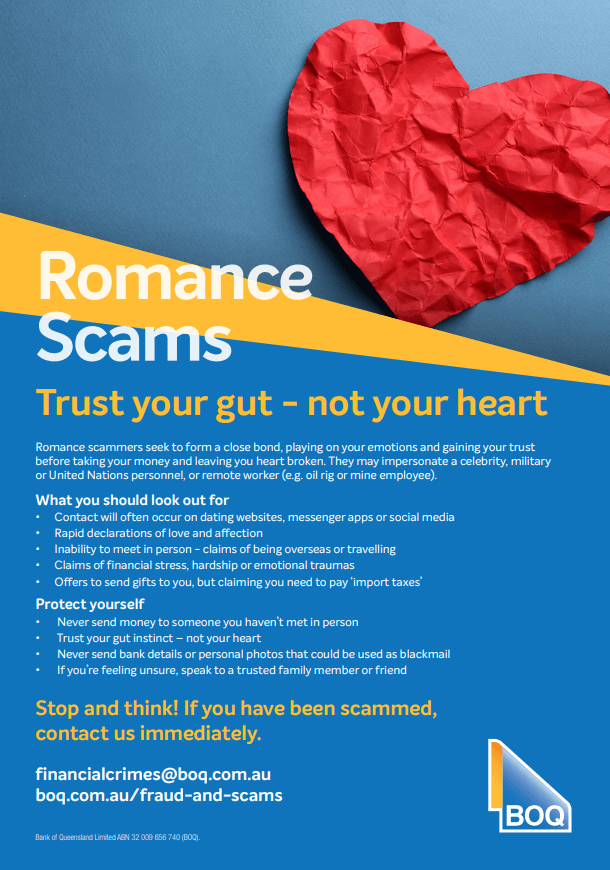

February 2023 - Valentine's Day Romance Scams

In the lead up to Valentine's Day, scammers cyber crims, and fraudsters are actively targeting those looking for love and companionship.

Romance Scams are particularly prominent around this time of year and can cause serious harm, financial and emotional distress. Emotional manipulation techniques and crafted vulnerability sadly sees more and more people continue to fall victim to these types of scams.

In some cases, the scammers may pretend to be:

- A member of the United Nations deployed in a remote warzone,

- A famous celebrity,

- Working on an oil ring and unable to access a bank.

Keep a look out for scammers who:

- Profess strong feelings after only a short time or few contacts,

- Bombard you with messages or texts,

- Have inconsistent information or images on their social media or other accounts,

- Who are hesitant or always come up with reasons not to meet in person or to talk via voice or video,

- Providing elaborate reasons why they require gifts, gift cards, money, or to gain your personal information.

How to protect yourself:

- Never send personal information such as bank details or personal photos that could be used as blackmail,

- Never send money to someone you haven’t met in person,

- If you're feeling unsure, speak to a trusted family member or friend,

- If they apply pressure to you, stop communicating.

Remember, if you see or experience a scam, report it.

To report a fraud or scam, attend your local branch or call us immediately on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours.

For more information about scams, please visit our Fraud & Scams Assistance Page: https://www.boq.com.au/help-and-support/fraud-and-scams

Other helpful links and resources:

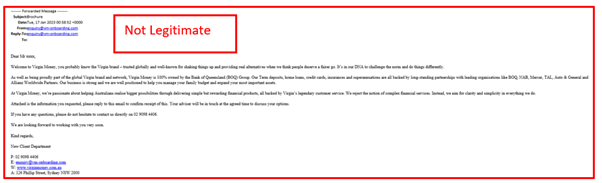

January 2023 - VMA Bond Term Deposit Scam

We have been made aware of a VMA branded imposter bond scam, similar to what ASIC reported in January. Scammers are attempting to adopt the identities of legitimate VMA employees and claiming, “to be selling Term Deposits of 3.75% - 6.25% with an investor deadline of 30th January 2023”.

Investors may be targeted from completing enquiry forms, via some third-party or comparison sites, or expressing an interest in investing online via BTDR (best-termdepositrates.com)

The imposter reportedly initiates and maintains contact with interested parties, sometimes over an extended period of time. During this time they may provide application instructions, maturity dates, investment thresholds, and other specific details surrounding possible investment options.

What to look out for

- Unrealistically high returns or bonds which seem ‘too good to be true’.

- Consistent pressure to invest due to the ‘risk of missing out’.

- Professional looking forms or prospectuses with either:

- ‘lookalike’ email addresses (e.g. enquiry@vm-onboarding.com )

- non-genuine phone numbers (e.g. 02 9099 1675, 02 9191 7412)

- Unusual requests for personal information.

- Being asked to pay funds directly into a bank account.

If you have any concerns about the legitimacy of correspondence, please seek independent financial advice or contact us directly (either via financialcrimes@boq.com.au or using the details on our https://www.boq.com.au/contact-us page).

January 2023 - BOQ Group Impersonation Calls

BOQ Group has been alerted to a new scam involving calls to customers from Private Numbers and Landlines where the callers are advising that they work for the BOQ Group. The callers are targeting customers who may have previously fallen victim to a scam and are citing various reasons for the call, including:

- to discuss 'fraudulent transactions' on your account,

- to inform that your funds are at risk due to an internal breach,

- to say that your funds need to be moved to a float account due to maintenance.

A risk of further compromise or financial loss is highlighted unless you follow the caller's instructions. These calls can sometimes occur after clicking on fake third-party links in text messages, which then request your details in an online form. The caller may ask you for your personal information, Internet Banking information, Card Numbers or to verify a One Time PIN sent to you. The caller may also recite details including names, DOB and email addresses which you may have used to fill out online forms.

Numbers the calls are coming from include (but are not limited to):

- 03 9708 4001

- 03 9000 8776

- xx 9144 7800

What to look out for:

- Callers typically call from Private Numbers, Victorian or New South Wales Landlines

- Victims have reported that in some cases the caller had a British accent

- Urgency is emphasised so that the scammers can pressure you to provide your personal information quickly

- Callers may allude to a security compromise with either your card, accounts, or internet banking but may struggle to provide any specific information.

- Callers may seem knowledgeable and may recite personal details that you have recently entered into an online form.

- Receiving phone calls soon after clicking on a link or entering phone number into an online form.

- Multiple calls from the same number claiming to be from different organisations/ banks.

- Callers informing you that your funds are not safe.

- Callers requesting funds to be transferred out due to maintenance.

How to protect yourself:

- If you receive an unexpected call or SMS, you should never click the link in the message or provide personal/banking information. Contact the company directly using a verified phone number or trusted channel to confirm the request.

- You should never share or disclose verification codes with a third party.

- If you think your account details or card details have been disclosed to a scammer, or if you receive a verification code that you didn’t request, immediately contact:

- ME Bank on 13 15 63 or using the details on our Contact Us page on the ME bank website - https://www.mebank.com.au/home/contact-us/.

- BOQ on 1300 55 72 72 or you can also let us know by emailing financialcrimes@boq.com.au or by visiting your nearest branch.

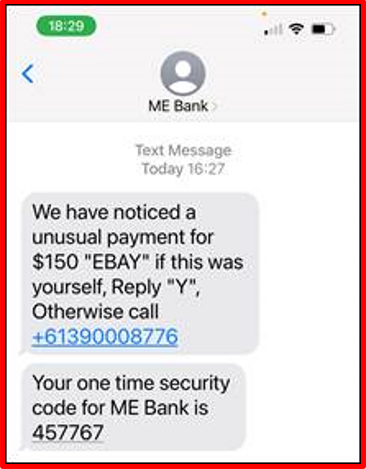

December 2022 - ME Bank Phishing Text Message

BOQ Group has been alerted to several phishing text messages that notify you that ME Bank has noticed an unusual payment from your account. The text message requests you to call +61390008776 if the transaction is not recognised and it appears to come from the ME bank user ID. The phone number provided takes you through to a scammer, who may ask you for your personal information, or to verify a One Time PIN sent to your mobile.

What to look out for and how to protect yourself:

- If you receive an unexpected call or SMS requesting payment, you should never click the link in the message or provide card/account information. Contact the company directly using a verified phone number or trusted channel to confirm the request.

- You should never share or disclose verification codes with a third party.

- If you think your account details or card details have been disclosed to a scammer, or if you receive a verification code that you didn’t request, contact ME Bank immediately on 13 15 63 or using the details on our Contact Us page on the ME bank website - https://www.mebank.com.au/home/contact-us/.

November 2022 - Online Shopping and Data Security

The busiest time of the year is approaching for online shopping, with enticing deals linked to Black Friday, Cyber Monday and the festive season already appearing in our inboxes and in the media.

Online shopping scams continue to be one of the most common threats to Australians. These scams carry significant risks, exposing individuals and businesses through fake product listings and payment requests, and non-secure payment avenues.

The increasing storage of personally identifiable information, including card details on sites visited at this time of year, continues to elevate the risk by exposing individuals and businesses to data hungry cybercriminals.

Once a cybercriminal has your bank details from one of these scams, not only will you be disappointed that your goods never arrived, but also that your identity and bank information has been stolen.

What to look out for:

- Requests for payments via bank transfer or virtual currencies.

- Links in emails asking for bank details or other information.

- Emails and messages about items yet to be delivered or where a fee is required to release a ‘failed’ delivery.

- Inadequate information about privacy, conditions of use, dispute resolution or contact details.

How to shop online securely:

- Use secure devices, avoid public wi-fi networks.

- Protect your payment information and accounts, avoid saving your payment details to online shopping accounts.

- Use trusted sellers.

- Know the warning signs.

If you receive any suspicious emails or messages, do not click any links or provide your card details. Be wary of online shopping deals and discounts, if it looks too good to be true, then it probably is.

If in doubt, contact BOQ:

If you have any concerns about the legitimacy of correspondence, contact us directly (either via financialcrimes@boq.com.au or using the details on our Contact Us page).

Report a cybercrime or cyber security incident to the ACSC via ReportCyber at www.cyber.gov.au/report, or call the Australian Cyber Security Hotline on 1300 CYBER1 (1300 292 371)

For more tips and resources, visit: https://www.boq.com.au/help-and-support/fraud-and-scams

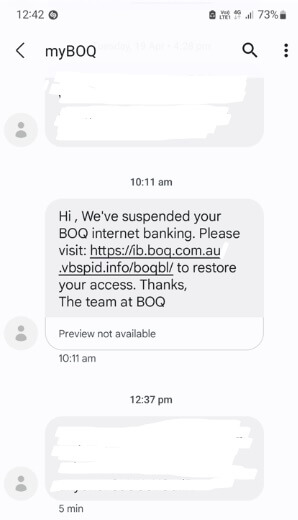

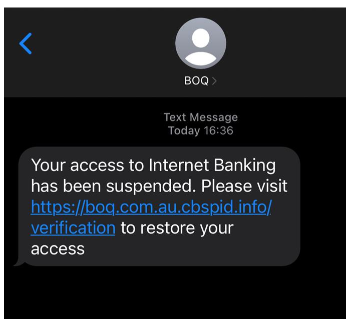

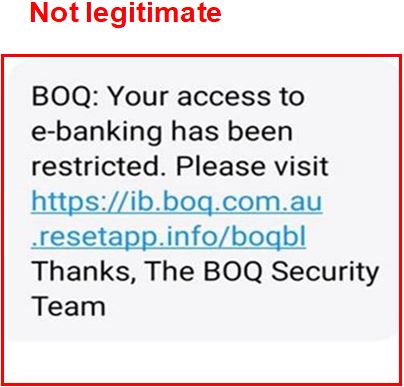

October 2022 - BOQ Phishing Text Message

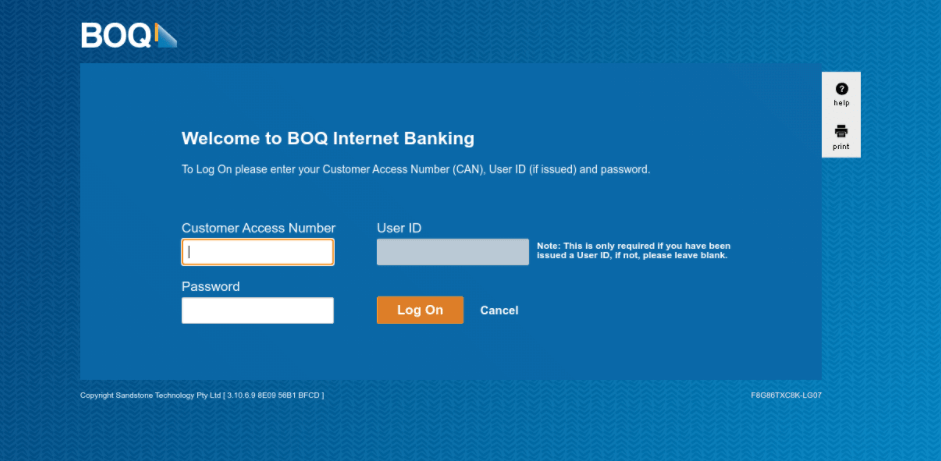

BOQ has been alerted to several phishing text messages that notify you that your BOQ or myBOQ e-banking or account has been restricted. The text message contains a hyperlink that takes you to a fake BOQ Internet Banking log-in page and may also be addressed to you.

The phishing website asks for your Customer Access Number (CAN) and password.

If you receive such a text message, do not click any links and do not provide your CAN or password. BOQ will never provide you with a link to log into your Internet Banking. Only access Internet Banking by typing www.boq.com.au into your internet browser.

Numbers the text messages are coming from include (but are not limited to):

- 0401 175 727

The URLs included may be one of the following:

- https://boqservicers.cc

- https://ib.boq.com.au.outd.info/boqbl/

- https://ib.boq.com.au.expired.tel/boqbl

- https://ib.boq.com.au.mobiupdate.info/boqbl

- https://itly/boqdevice

- https://bit/boqdevice

- https://bit.ly/3yco4Xx

If in doubt, contact BOQ:

- via email at Financialcrimes@boq.com.au

- by visiting your local branch

- on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours.

For more tips and resources, visit: https://www.boq.com.au/help-and-support/fraud-and-scams

September 2022 - Online Security

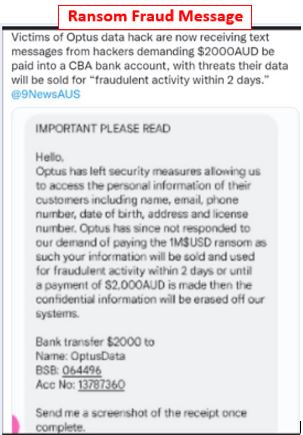

Scams and fraud can happen to anyone. That’s why BOQ’s Fraud & Scams Operations Team monitors customer accounts for any suspicious activity including consideration of events such as the recent Optus data breach.

For more information regarding the Optus data breach and what this may mean for you, visit:

https://www.idcare.org/optus-db-response

To take extra steps to keep yourself and your loved ones safe from scams, here are some handy tips:

👉Don’t click on links within unsolicited text messages, emails or social media messages. Go to directly the app or website by entering the correct details yourself

👉When it comes to unknown phone calls, check the number and call the organisation directly using their legitimate details

👉Update your passwords, using a strong password not used for other accounts. Add two-factor authentication (2FA) to internet banking and personal accounts

👉Monitor your transactions regularly, consider using PayID and review the payment transfer limits on your accounts

👉If your identity has been compromised, contact us. You can also explore more via reputable sources such as scamwatch.gov.au, cyber.gov.au and idcare.org.

To report a fraud or scam, call us immediately on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours. You can also let us know by emailing financialcrimes@boq.com.au or by visiting your nearest branch.

For more tips and resources, visit: https://www.boq.com.au/help-and-support/fraud-and-scams

September 2022 - Digital Wallet Phishing Scams

Individuals have reported receiving a message via SMS using the brand of well-known companies such as Netflix and Linkt to target customers and gain their personal information and card details by saying that your payment information needs to be updated, you have unpaid tolls or your account has been suspended due to a payment failing.

The SMS contains a link to a legitimate looking website and prompts you to enter your card information. These details are being used to register the card information to a digital wallet on the mobile device of the scammer.

To complete the Digital Wallet registration, a verification code is sent via SMS and when this code is obtained the scammer, they can successfully register the victim’s card to their own Digital Wallet and make purchases.

What to look out for and how to protect yourself:

- If you receive an unexpected call or SMS requesting payment, you should never click the link in the message or provide card/account information. Contact the company directly using a verified phone number or trusted channel to confirm the request.

- You should never share or disclose verification codes with a third party.

- If you think your account details or card details have been disclosed to a scammer, or if you receive a verification code that you didn’t request, contact BOQ immediately at financialcrimes@boq.com.au or using the details on our Contact Us page.

For more information about scams, please visit our Fraud & Scams Assistance Page.

https://www.boq.com.au/help-and-support/fraud-and-scams

Other helpful links and resources:

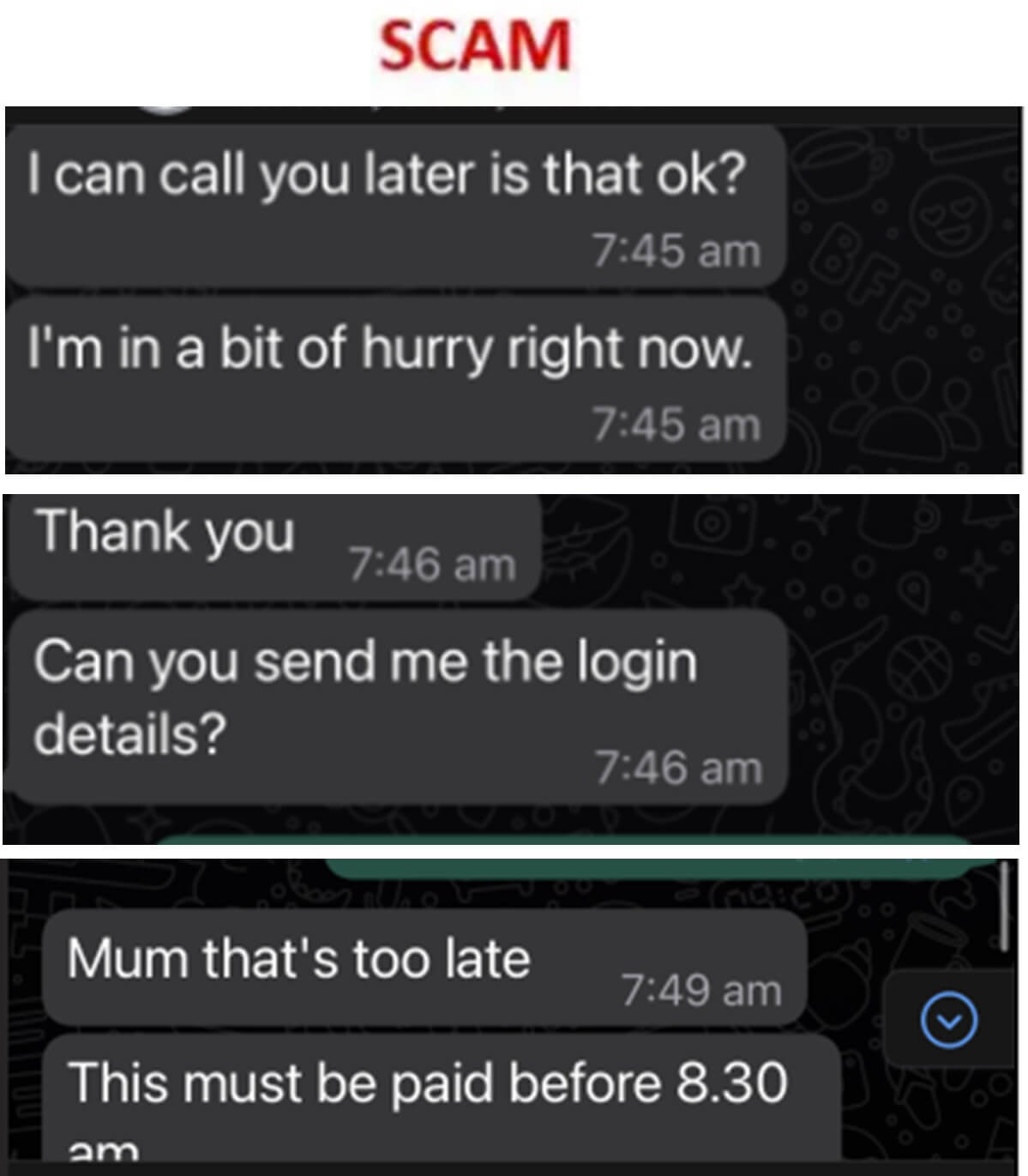

August 2022 - Family Impersonation Scam via WhatsApp, Text-Message and Social Media

BOQ continue to see an increase in reports where victims are being contacted by individuals claiming to be a family member requesting financial assistance to help pay invoices, outstanding bills or to repay debts.

These requests are being received via a range of popular messaging services where the sender advises they have recently changed phone numbers and to request you to delete and block their old number.

Once this has been completed, they will request you to provide or lend funds or even hand over login credentials to your Internet Banking.

In a recent publication from the Australian Communications and Media Authority (amca.gov.au)

"These messages often begin with a "Hi Mum" and could provide several different reasons why they are using a different phone number including switching providers or having a lost or broken phone"

https://www.acma.gov.au/articles/2022-08/consumer-warning-lost-phonenew-number-scams

BOQ urge the community to remain aware and vigilent to the increase in these types of scams and if you do receive a request similar to this, to contact that family member via a trusted channel to validate the request.

If you have any concerns about the legitimacy of any correspondence, contact us directly (either via financialcrimes@boq.com.au or using the details on our Contact Us page).

If you think you have paid money to a scammer, contact your bank immediately.

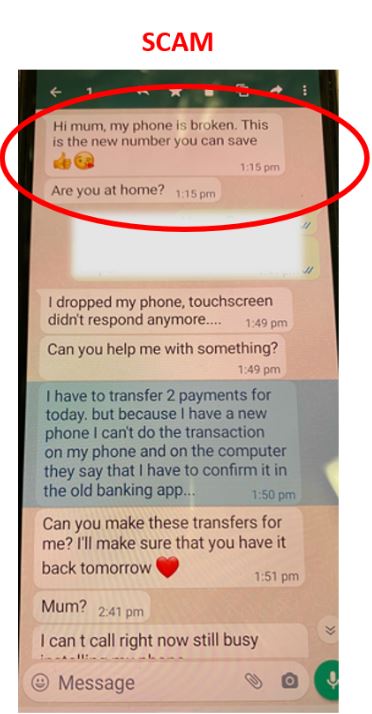

June 2022 - WhatsApp Impersonating Family or Children Scam

A scam trend has emerged where you may be contacted via Whatsapp, SMS or other Social Media from individuals claiming to be family or children who are in urgent need of money (Ref: 2022, June 01. Yahoo!News).

Victims have reported receiving messages stating, ‘Hi Mum’ or ‘Hi Dad’, the scammer then claims that their phone has been lost, stolen or damaged and the number they are contacting them on is their new contact number, and request their victim to save the new number.

The scammer, purporting to be a family member, may claim that they are in trouble with an authoritative figure such as the police, or that they have urgent payments or bills which they are unable to pay due to their phone being lost or broken. The scammer urgently requests the victim to make the payment on their behalf as soon as possible and that they will return the money promptly.

What to look out for and how to protect yourself:

- Be cautious of all approaches you did not initiate, especially if you are asked to send money online.

- Messages requesting money may become more desperate, persistent, or direct. If you do send money, they continue to ask you to send more.

- Do not respond to the contact unless you are 100% sure if they are genuine.

- Confirm the identity of the contact by calling the supposed family member directly via a reliable or previously known contact number.

- Do not conduct any payments or transfers instructed by the third party until you have verbal confirmation over the phone from the intended recipient/family member.

- Do not provide your banking details, Visa debit Card details or your personal information to anyone over messages, especially on a message that you did not initiate.

If you have any concerns about the legitimacy of correspondence, contact us directly (either via financialcrimes@boq.com.au or using the details on our Contact Us page).

If you think you have paid money to a scammer, contact your bank immediately.

Helpful Links and resources:

https://au.news.yahoo.com/whatsapp-mum-and-dad-scam-explained-police-issue-warning-140347728.html

May 2022 - BOQ Phishing Text Message

BOQ has been alerted to a phishing text message that notifies you that your BOQ e-banking has been restricted. The text message contains a hyperlink that takes you to a fake BOQ Internet Banking log-in page.

The phishing website asks for your Customer Access Number (CAN) and password.

Just because the SMS has “BOQ” in the sender name doesn’t mean it’s real.

Provided the SMS service a scammer is using has the option for a send name, they can send it out using a familiar name. In fact, if you have already received messages from that name, your phone will combine them all, helping the ruse.

But there is one thing you need to pay attention to in order to prove the message is a scam: the URL or domain.

How the URL proves a scam message is a scam

You can’t fake a URL in an SMS or a web browser, and it’s something where if you pay attention to what you’re seeing, you can help ensure you don’t get scammed.

On an SMS, the URL should be what you’re going to. Do not click any links and do not provide your CAN or password that have the below in the URL:

au.cbspid

au.vbspid

au.auth-required

BOQ will never provide you with a link to log into your Internet Banking. Only access Internet Banking by typing www.boq.com.au into your internet browser.

Numbers the text messages are coming from include (but not limited to):

+61 497 823 077

If in doubt, contact BOQ via email at Financialcrimes@boq.com.au, by contacting your local branch, or on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours.

March 2022 – Scams Targeting Flood-Impacted Communities

Unfortunately, there are a number of scams to be aware of during the period after a Natural Disaster.

Scammers may pretend to be government agencies providing information on flood/disaster relief through text messages and emails ‘phishing’ for your information. These contain malicious links and attachments designed to steal your personal and financial information.

Scammers are also pretending to be Government agencies and other entities offering to help you with applications for financial assistance or payments for disaster relief.

Fundraising appeals often occur in the aftermath of a disaster. Unfortunately, some of these are scams.

What to look out for and how to protect yourself:

- Be cautious of all approaches you did not initiate, especially if you are asked to send money online.

- Confirm the identity of the contact by calling the organisation directly. Do not respond to the contact if you’re not 100% sure.

- Do not disclose personal information in a phone call, such as sharing your bank account screen, reading out passwords, or providing personal information or login details to MyGov.

- Trusted organisations will not ask for an upfront payment to process recovery payments. Requests from Services Australia and government departments can be verified with a call to special hotlines made available on their websites.

- If you donate to an established charity or not-for-profit organisation, make sure it is registered. You can do this by searching through the Australian Charities and Not-for-profits Commission Charity Register - https://www.acnc.gov.au/charity/programs/map

If you have concerns about the legitimacy of correspondence, contact us directly via email at Financialcrimes@boq.com.au or using the details on our Contact Us page.

If you think you have paid money to a scammer, contact your bank immediately.

Helpful Links and resources:

https://www.cyber.gov.au/report-and-recover/recover-from/scams

https://www.scamwatch.gov.au/types-of-scams/attempts-to-gain-your-personal-information/phishing

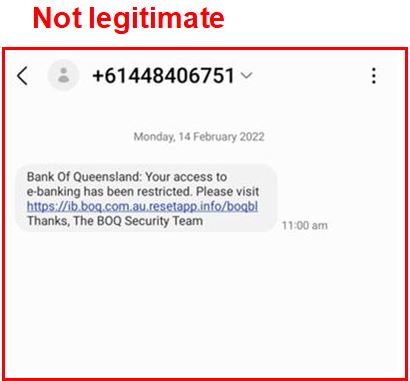

February 2022 - BOQ Phishing Text Message

BOQ has been alerted to a phishing text message that notifies you that your BOQ e-banking has been restricted. The text message contains a hyperlink that takes you to a fake BOQ Internet Banking log-in page. The phishing website asks for your Customer Access Number (CAN) and password.

If you receive such a text message, do not click any links and do not provide your CAN or password. BOQ will never provide you with a link to log into your Internet Banking. Only access Internet Banking by typing www.boq.com.au into your internet browser.

Numbers the text messages are coming from include (but not limited to):

0448406751, 0488066702, 0448667492, 0448579987, 0401612002, 0467361937

0467686381, 0448347159, 0487110981, 0475843120, 0438404505, 0499616961

0448220275, 0488342114, 0448639221

If in doubt, contact BOQ via email at Financialcrimes@boq.com.au, by contacting your local branch, or on 1300 55 72 72 , visit www.boq.com.au/contact-us for our operating hours.

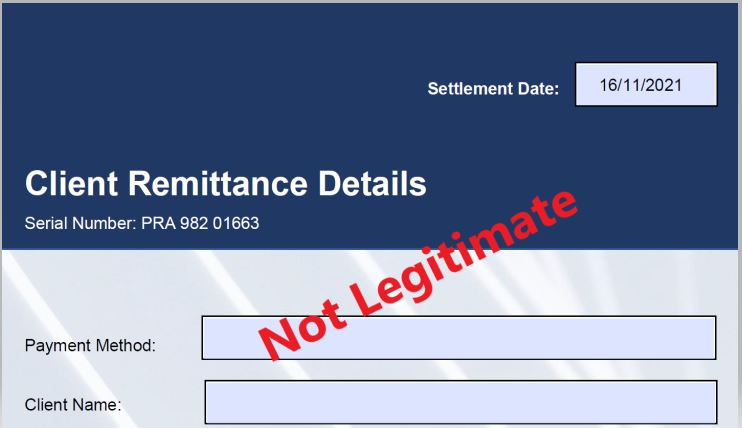

November 2021 – BOQ Branded Capital Protected Fixed Income Government Funds Scam

BOQ are continuing to report the prevalence of BOQ branded imposter investment scams, similar to what ASIC reported in January. Scammers are attempting to adopt the identities of legitimate BOQ employees and claiming to be selling BOQ Treasury Bonds or Capital Protected Fixed Income Government Funds.

Investors may be targeted from completing enquiry forms, via some third-party or comparison sites, or expressing an interest in investing online.

The imposter reportedly initiates and maintains contact with interested parties, sometimes over an extended period of time. During this time they may provide application instructions, maturity dates, investment thresholds, and other specific details surrounding possible investment options.

What to look out for

· Unrealistically high returns or bonds which seem ‘too good to be true’.

· Consistent pressure to invest due to the ‘risk of missing out’.

· Professional looking forms or prospectuses with either:

o ‘lookalike’ email addresses (e.g. info@boqau.com, david.freeman@boq-investments.com, )

o non-genuine phone numbers (e.g. 07 3999 7455, 02 9136 2538)

· Unusual requests for personal information.

· Being asked to pay funds directly into a bank account.

If you have any concerns about the legitimacy of correspondence, please seek independent financial advice or contact us directly (either via financialcrimes@boq.com.au or using the details on our Contact Us page).

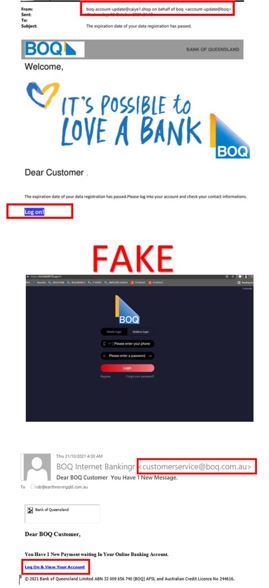

October 2021 – BOQ Phishing Email

BOQ has been alerted to a phishing email that advises you have a new message in your online banking account. The email contains a hyperlink that takes you to a fake BOQ Internet Banking log-in page. The phishing website asks for your Customer Access Number (CAN) and password.

If you receive such an email, do not click any links and do not provide your CAN or password. BOQ will never provide you with a link to log into your Internet Banking. Only access Internet Banking by typing www.boq.com.au into your internet browser.

If in doubt, contact BOQ on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours or email Financialcrimes@boq.com.au

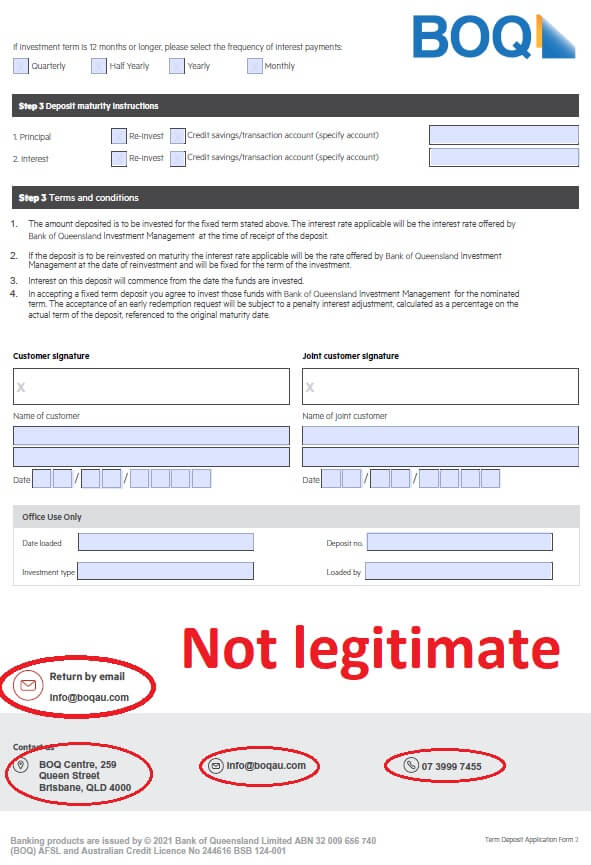

October 2021 – BOQ Branded Imposter Bond Scam

We have been made aware of a BOQ branded imposter bond scam, similar to what ASIC reported in January. Scammers are attempting to adopt the identities of legitimate BOQ employees and claiming, “to be selling treasury bonds at 5.75%”.

Investors may be targeted from completing enquiry forms, via some third-party or comparison sites, or expressing an interest in investing online.

The imposter reportedly initiates and maintains contact with interested parties, sometimes over an extended period of time. During this time they may provide application instructions, maturity dates, investment thresholds, and other specific details surrounding possible investment options.

What to look out for

- Unrealistically high returns or bonds which seem ‘too good to be true’.

- Consistent pressure to invest due to the ‘risk of missing out’.

- Professional looking forms or prospectuses with either:

- ‘lookalike’ email addresses (e.g. info@boqau.com)

- non-genuine phone numbers (e.g. 07 3999 7455)

- Unusual requests for personal information.

- Being asked to pay funds directly into a bank account.

If you have any concerns about the legitimacy of correspondence, please seek independent financial advice or contact us directly (either via financialcrimes@boq.com.au or using the details on our Contact Us page).

September 2021 – Apple iOS, macOS and Safari vulnerabilities

Apple have identified two vulnerabilities in the operating systems of multiple devices (e.g. iPhone, iPad, Apple Watch, MacBook). This Australian Cyber Security Centre (ACSC) alert lists the operating systems affected.

Some vulnerable devices may be exposed to being infiltrated by hackers who can execute code to install malware or take other actions. All without the user clicking any links. This may enable criminals to steal personal data or interfere with, or compromise, banking services.

How to protect yourself

- Update your Apple mobile and laptop/personal computer devices immediately.

- Setup automatic software updates on your mobile devices and laptops/personal computers.

- Install reputable antivirus and anti-theft/loss protection software, only from official sources (e.g. App Store or Google Play Store for mobile devices).

- On mobile devices, adjust settings to require a password before installing new applications.

- Avoid letting your device automatically connect to new WiFi networks without confirmation.

- Consider registering to the ACSC Alert Service.

If you have any concerns of your banking services having been compromised, contact BOQ urgently on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours. or email financialcrimes@boq.com.au

June 2021 – Ponzi/Pyramid Scheme Apps

BOQ customers have recently been falling victim to Ponzi/pyramid scheme apps, such as the ‘Hope Business App’.

A Ponzi scheme is an investment scam, where participants are paid profits from the funds collected from new participants. Often, participants must pay an up-front fee, around $200-$500, before they can start earning. The schemes then use this joining fee to pay the ‘commission’ or ‘service rewards’ of earlier participants.

Early participants may see some return of funds and thus believe the scheme to be legitimate. However, some BOQ customers have reported being unsuccessful in cashing out any funds from these apps.

You can read more about this from a recent Queensland Police post.

What to look out for

- Substantial up-front or ‘joining’ fees.

- Promises of high returns with little or no risk.

- Pressure to invest further funds.

- Apps removed from Apple’s App Store or Google’s Play Store.

- Unregistered company who ‘promotes’ the app or scheme.

Remember, if it’s too good to be true, it probably is. If in doubt, contact BOQ urgently on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours..

May 2021 - Threat and Penalty Scams

We have seen a rise in Threat and Penalty Scams made against our customers.

Scammers have been calling BOQ customers and impersonating legitimate government or law enforcement agencies. The scammers make threats of arrest, legal action or compromised account activity. Scammers then ask customers to make a payment to them or to a 'secure account'.

To appear legitimate, some scammers may ask for the customer’s local police station and claim they will receive a phone call. These scammers then spoof (imitate) the police station’s phone number in order to convince the customer of the legitimacy of the call. Unfortunately, this has resulted in some BOQ customers falling victim and making a payment to the scammers.

If you receive any calls claiming to be from a government department or law enforcement agencies making similar threats, hang up the phone immediately. Call the government department or law enforcement agency back on a trusted number e.g. from their website.

If in doubt, contact BOQ urgently on 1300 55 72 72 visit www.boq.com.au/contact-us for our operating hours.

December 2020 - Phishing

BOQ has been alerted to a phishing email that advises you have a new message in your online banking account. The email contains a hyperlink that takes you to a fake BOQ Internet Banking log-in page. The phishing website asks for your Customer Access Number (CAN) and password.

If you receive such an email, do not click any links and do not provide your CAN or password. BOQ will never provide you with a link to log into your Internet Banking. Only access Internet Banking by typing www.boq.com.au into your internet browser.

If in doubt, contact BOQ urgently on 1300 55 72 72, visit www.boq.com.au/contact-us for our operating hours.

September 2023 – BOQ Impersonation Scam

BOQ are aware of a new fraud trend where customers are receiving phone calls from UK based third parties claiming to be representatives of the bank.

During these calls, scammers will pose as employees from Bank of Queensland and attempt to gain a large amount of personal information from you, often including full legal name, Internet Banking log in information, Visa card numbers, date of birth and one-time verification codes.

Using this information gained from you, the scammers will then use a number of techniques to gain access to your funds.

The scammers may attempt to:

- Complete fraudulent charges on your card by adding your card number to their digital wallet,

- Pose to be you in order to make changes to your banking profile including increasing daily limits, resetting your Internet Banking password or changing your contact details,

- Log in to your Internet Banking profile to access your funds.

What to look out for:

- Unsolicited calls, emails or text messages claiming to be from BOQ (remember scammers can mask what number they are contacting you from and whilst it may appear to be genuinely from BOQ it could still be fraudulent)

- Requests for sensitive information from someone claiming to be BOQ

- Urgent or threatening language

- Communication with grammar or spelling errors

How to protect yourself:

- If you receive an unexpected call from someone claiming to be BOQ or another authority, hang up the call immediately and call the organisation back via a trusted phone number.

- Never disclose personal information and card numbers or other banking information on an unsolicited phone call.

- If you receive any suspicious correspondence, stop and call BOQ immediately to confirm if it is genuine.

If in doubt, contact BOQ:

- To report a fraud or scam, attend your local branch or call us immediately on 1300 55 72 72 (Monday-Friday, 8am-8pm AEDT, and Saturday 9am-5pm AEDT).

- Report a cybercrime or cyber security incident to the ACSC via ReportCyber at www.cyber.gov.au/report, or call the Australian Cyber Security Hotline on 1300 CYBER! (1300 292 371).