Tips to Pay Off Your Home Loan Faster

Here's some tips to pay off your mortgage faster with extra repayments, a mortgage offset account and more frequent repayments

Here's some tips to pay off your mortgage faster with extra repayments, a mortgage offset account and more frequent repayments

Owning your own home is the great Australian dream. But for most that means factoring repayments into the family budget and that is a big commitment. Want to know how to pay off your home loan quicker and put more money back into your pocket? If you are on a Principal and Interest loan, we have some tips on how to pay off your mortgage faster.

Dreaming of a mortgage-free life? Consider making extra repayments on your loan on top of the minimum repayment amount.

This could be as part of your scheduled repayments or on an ad-hoc basis when you have some spare money to throw into your home loan. This will reduce your loan balance so you’ll pay less interest and pay off your loan sooner.

And don’t forget, if you need the funds at a later time, you can easily access the extra repayments via redraw on all of BOQ’s variable rate loans (excluding Economy). For fixed rate loans at BOQ, you can make up to $10,000 in extra repayments per year before Break Costs apply and you can only redraw once the loan switches over to a variable rate.

Did you know that you can choose the frequency of your home loan repayments?

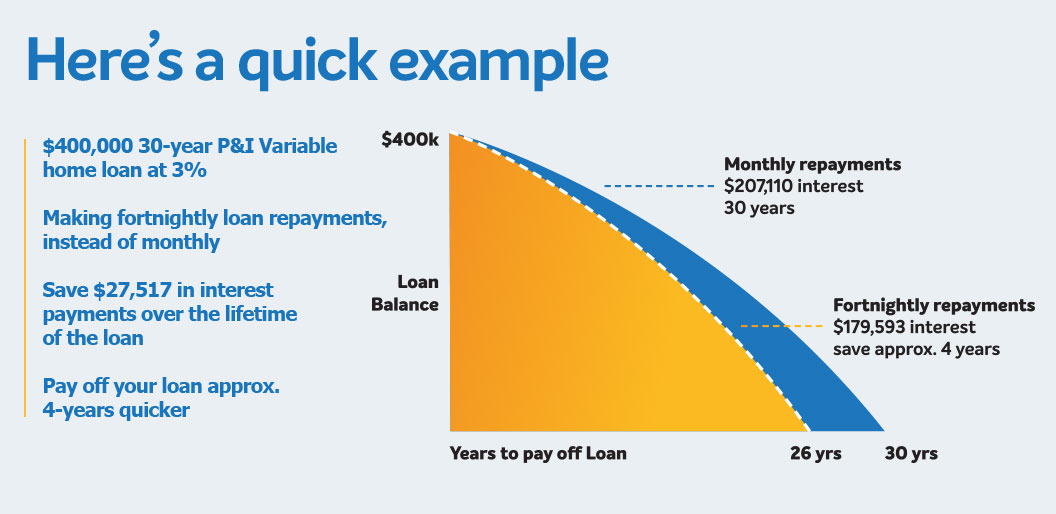

This may not sound like a big deal, but if you switch from monthly repayments to fortnightly repayments you could pay off your variable rate home loan sooner.

The more regular you make your home loan repayments, the faster you are reducing the balance of your loan and the less interest you’ll be paying.

If you can afford to change from monthly repayments to fortnightly, you’ll halve the amount of each repayment, while making 26 repayments per year. This means you pay an extra month off your loan every year without even noticing – paying it off faster and incurring less interest and fees over the lifetime of the loan.

If you’d like to know more about home loan payment frequency, call us, pop into a branch or speak to your broker.

Did you know BOQ variable rate home loans (excluding Economy) come with a linked mortgage offset account?

A mortgage offset account is an everyday transaction account that’s linked directly to your home loan.

The benefit of an offset account is that the account balance is subtracted from your home loan balance before interest is calculated. This means you can reduce the amount of interest you pay, helping you pay off your mortgage even faster.

The more funds you hold in your offset account, the less interest you pay on your home loan, so you could choose to transfer your salary and other savings into this account.

It works exactly like a normal transaction account, so it’s great for everyday banking. There’s no account maintenance fee, unlimited transactions and you get a linked BOQ Visa Debit Card.

Learn about a mortgage offset account

Don’t be afraid to change the structure of your loan to keep it working hard for you. Thinking about locking your loan into a low fixed rate, but not sure? Consider splitting your home loan.

You’ll be able to enjoy the flexibility of a variable rate and the certainty of a fixed rate. This could allow you to have lower repayments set on the fixed rate split and the flexibility to offset against the variable rate split if you have some spare funds available.

Pay off your home loan faster and reduce the interest on your home loan

Splitting your home loan can give you the benefits of both fixed rate home loans and variable rate home loans.

We’re here to answer any questions you may have.