BOQ 1H20 Results Announcement

Wednesday, 08 April 2020

1H20 financial summary (1)

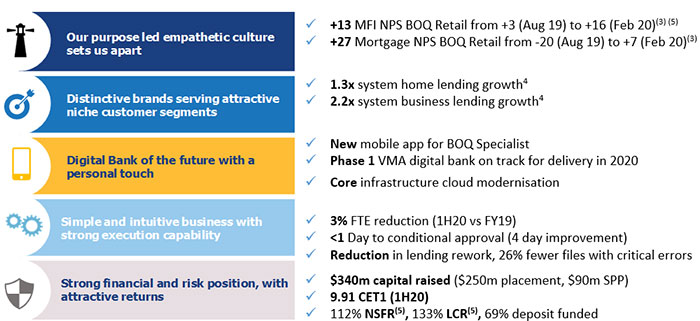

- Common Equity Tier 1 (CET1) capital ratio of 9.91%, up 87 basis points from FY19

- Cash earnings after tax of $151 million, down 10% on PCP and 1% down on 2H19

- Statutory net profit after tax of $93 million, down 40%

- Gross loans of $47 billion, up 3%

- Flat revenue growth; Operating expense growth of 9%

- Net Interest Margin (NIM) of 1.89%, down 3 basis points from FY19

- Loan Impairment Expense of $30 million or 13 basis points of gross loans, flat on 1H19

- Basic earnings per share down 16% to 35.3 cents per ordinary share

- Return on average ordinary equity of 7.5%

- Decision on payment of interim dividend deferred (2)

- Strong funding position with customer deposits flat at $32 billion and liquidity coverage ratio of 133%

Bank of Queensland Limited (ASX: BOQ) today announced 1H20 cash earnings after tax of $151 million, down 10 per cent on 1H19, and down 1% on 2H19. Statutory net profit after tax decreased by 40 per cent to $93 million. This was largely a result of the previously guided restructuring charges and intangible asset review.

In light of APRA’s guidance issued on 7 April 2020, BOQ has deferred the decision on payment of an interim dividend (2).

During the half, BOQ has delivered strong balance sheet growth while maintaining asset quality across the portfolio. The strong capital and liquidity positions will ensure stability during this period of economic uncertainty.

Managing Director and CEO George Frazis commented: “In these extremely uncertain times, we are doing all we can to support our customers and our people with prudent and meaningful measures and to ensure the strength of the bank. I am proud of how our people have responded, swiftly adapting to this unprecedented event. We are here for our customers and we will work with them through the challenges ahead.”

1H20 results as expected during transitional year

BOQ’s 1H20 results reflect a transitional year for BOQ. Revenue and Loan Impairment Expense (LIE) are in line with 1H19, with increased expenses relating to investments in technology, and risk and regulatory compliance.

While total income of $541 million for the half was flat, net interest income increased one per cent to $483 million, driven by $781 million of lending growth in 1H20, offset by a three basis points contraction in NIM to 1.89 per cent over the half. Non-interest income decreased by 11 per cent on 1H19 to $58 million.

Operating expenses increased four per cent compared to 2H19 to $292 million due to increased expenses from risk and regulatory programs, and investment in strategic technology projects. The productivity review has delivered a four per cent reduction in headcount during the half.

The underlying asset quality of the portfolio remains sound. Impairment expenses were flat at $30 million for 1H20 versus PCP, equivalent to 13 basis points of gross loans, notwithstanding a $10 million increase in the collective provision in response to the potential impacts of COVID-19, based on an assessment of market conditions as at 29 February 2020.

Momentum across the housing and commercial lending portfolios

Gross loans and advances rose $781 million to $47 billion in the half. The focus on niche segments has seen improvements in lending growth across all brands.

BOQ Specialist grew lending balances by $502 million across its commercial and housing loan portfolios. Virgin Money Australia (VMA) also delivered another strong half with $489 million of growth in its housing portfolio, which now stands in excess of $3 billion. BOQ Business delivered a further $189 million of growth in its commercial portfolio during 1H20. BOQ remains focused on rebuilding the BOQ branch and broker housing loan portfolio, which contracted a further $441 million during the half, which is showing signs of a turnaround.

“It’s pleasing to see the momentum building in both the housing and commercial portfolios. Both VMA and BOQ Specialist have continued to grow their housing portfolios, with BOQ Retail still contracting but driving an improvement on the previous periods through increased acquisition volumes,” Mr Frazis said.

Strong balance sheet and capital position, providing ability to respond to changing conditions

BOQ remains well capitalised with a CET1 ratio of 9.91 per cent, an increase of 87 basis points during the half. Funding remained broadly stable during the half with customer deposits flat at $32 billion, representing a deposit to loan ratio of 69 per cent. Good liquidity has been maintained with a Liquidity Coverage Ratio of 133 per cent as at 29 February 2020, with further strengthening expected from the RBA Term Funding Facility.

“BOQ is well capitalised, providing us with the necessary buffer to respond to rapidly changing economic conditions. We moved early to strengthen our capital position, raising a total of $340 million in the recent capital raising, which included our proactive decision to increase the size of the retail share purchase plan to $90 million,” Mr Frazis said.

Delivering on the strategy

Sound progress has been made on a number of foundational investments during the half. BOQ’s core infrastructure modernisation is well progressed and will deliver a modern, cloud-based technology environment. Phase 1 of the VMA digital bank is tracking to plan to deliver a digital transaction, savings and credit card offering to customers. Both of these programs are building the foundation for BOQ’s technology transformation towards a digital banking platform to be leveraged across the BOQ Group. These programs are expected to be completed in calendar year 2020.

In addition, a number of investments have been delivered during the half that provide an improved experience for BOQ’s customers. These include a new mobile app for BOQ Specialist customers, a new telephony platform for the contact centres, the introduction of a new customer relationship management tool for the frontline Retail banking teams, and the first phase of the home buying transformation program, which has reduced the time to conditional yes for customers from 5 days to less than 1 day and increased NPS by 27 points.(6)

“We are continuing to execute against this strategy in order to transform BOQ and have the flexibility to adjust or re-sequence our capital investment program as and when market conditions require us to pivot,” Mr Frazis said.

Material shift in the environment due to COVID-19

The rapid global escalation of COVID-19 and subsequent actions to contain the virus have resulted in extraordinary economic dislocation. The timely, welcome and extensive response from the Federal Government and regulators is focused on cushioning this impact by supporting jobs and businesses to manage through COVID-19 and re-emerge. BOQ is entering this period in a strong position, with high levels of capital, good liquidity and sound underlying portfolio quality.

Potential financial implications of COVID-19

The potential impact of COVID-19 on the collective provision is subject to significant uncertainty. Based on the facts and circumstances existing at 29 February 2020, a $10 million COVID-91 overlay was recognised in 1H20. Inclusive of this $10 million overlay, based on forecasts of future economic conditions and other supportable information available as at 7 April 2020, the estimated impact of COVID-19 in FY20 is in the range of $49 million-$71 million7.

Supporting our customers

BOQ has been actively working with the Australian Banking Association, the Federal Government and regulators to structure a number of industry responses aimed at supporting its customers, employees and the wider community through this period of significant social and commercial dislocation.

BOQ is offering its customers assistance through a number of initiatives, including:

- Deferred repayment periods of up to six months on business loans up to $10 million;

- The option to choose between deferred mortgage repayments or Interest Only repayments for an initial period of three months; and

- Fast-track hardship assistance where impacted customers can urgently access a range of other financial relief measures.

Further details of our banking relief packages can be found here.

"BOQ is well positioned as we enter this period with a strong balance sheet, capital and liquidity buffers, and sound asset quality. While it remains difficult to assess the impact of COVID-19 on the economy, our customers and, as a result, our business, we are well-positioned to adapt to this challenging, rapidly changing environment. We remain focused on the execution of our strategy, building on the strong foundations to deliver a return to growth when the economy improves.”

(1) 1H20 vs 1H19 comparisons unless otherwise stated. Figures are on a cash basis unless otherwise stated.

(2) Refer to BOQ ASX Release “BOQ FY20 Interim Dividend Deferral”, 8 April 2020.

(3) RFi XPRT Reports August 2019 to February 2020.

(4) Internal BOQ Analysis and APRA monthly authorised deposit-taking institution statistics excluding International Banks, Sep2019 – Feb 2020.

(5) Definitions: MFI: Main Financial Institution, NPS: Net Promoter Score, NSFR: Net Stable Funding Ratio, LCR: Liquidity Coverage Ratio.

(6) Source: RFi XPRT NPS Survey, August 2019 to February 2020.

(7) This range may move materially as events unfold. Due to this, this number should not be seen as firm guidance as to the final financial impacts.

ENDS

Authorised for release by: The Board of Directors of Bank of Queensland Limited

Results audio webcast:

BOQ’s results teleconference will be held today at 10:30am (Sydney time).

The webcast address is: https://edge.media-server.com/mmc/p/hw7ma2wq

Teleconference details are as follows:

Dial-in number (Australia): 02 9007 3187 or Toll Free 1800 558 698

Dial-in number (International): +617 3145 4010