Housing and Financial Market Update: Not (quite) yet at the bottom

Summary:

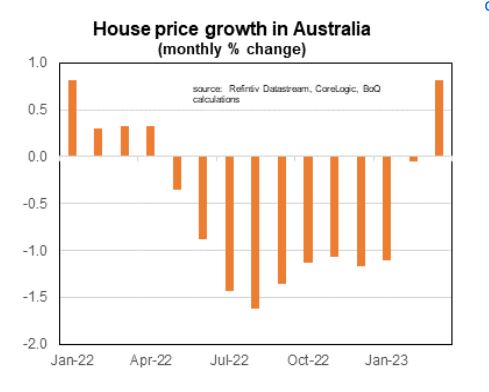

- House prices rose surprisingly in the month of March despite higher interest rates;

- A decline in the supply of homes for sale was the likely reason for the rise;

- The risk of a further rise in interest rates and weakening economic growth means it is too early to call the bottom of house prices;

- Strong population growth is boosting underlying demand;

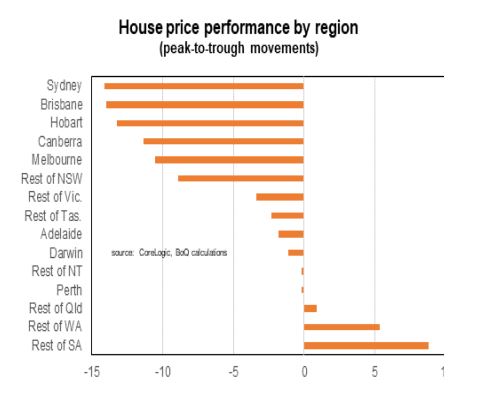

- DThe Perth, Darwin and Adelaide housing markets will outperform amongst capital cities in this housing cycle.

The RBA decided to keep the cash rate unchanged for the first time since April 2022. I agree with its read on the economy. Economic growth is slowing but still decent. Inflation has peaked but remains too high. Despite the better data over recent weeks the outlook is for a weaker global economy over the next year. Global inflation has not declined as quickly as expected. The recent financial market instability is likely to lead to some weakening of the global economy.

After the March meeting, the RBA nominated four pieces of data that would help it determine whether there should be another rate hike in April. One was the labour market numbers that had shown a (modest) rise in the unemployment rate in December-January. The February jobs number was undeniably strong. The RBA though expected a sharp bounce back in jobs growth (for technical reasons associated with changing seasonal patterns influencing the economy).

A second bit of data was business surveys. They indicated that in February firms thought that conditions remained solid, with order books growing at an above-average clip. Firms reported that while price growth was slowing it remained high. That message of slowing but still high inflation was confirmed in the February CPI (the third piece of data).

The fourth was the retail sales figures that indicated that spending rose only modestly in February. Given the backdrop of high inflation much of that rise in spending almost certainly was a result of higher prices (implying a decline in volumes). A slowing of spending on goods has been expected as consumers switch more of their spending towards services post lockdowns. But growth in spending at restaurants also appears to be weakening. This suggests that rising cost of living and increasing interest rates is taking a toll on households.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist