Economic and Financial Market Update: Budget Update Episode Two

Summary:

- The Budget did what was advertised: it updated the economic outlook and the change in Government priorities;

- The economic forecasts appear reasonable albeit conservative;

- The 2022-23 Budget deficit is now forecast to be substantially narrower primarily reflecting the benefit of higher commodity prices;

- The clearest message from the Budget is the structural budget problem with spending projected to be sustainably higher than revenue.

Economic Forecasts

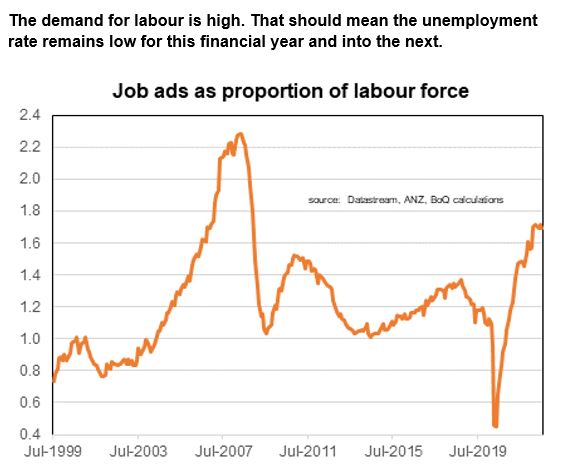

Every year Treasury’s forecasts are examined for what they say about the economic outlook. Mostly they are in line with the consensus. And that is broadly the case again this year. The unemployment rate is expected to remain low for much of this year before picking up over the following two years as the economy slows. The tough time firms have had over the past year in finding staff could mean that the unemployment rate forecast that Treasury has may prove a little pessimistic. Given the global economic and interest rate rise backdrop taking a cautious view though is best. Most analysts (including Treasury and myself) do not expect Australia to enter recession although there is a high chance of an economic slowdown.

The inflation rate is projected to peak by the end of this calendar year although is not expected to re-enter the RBA’s 2-3% target until 2024. A peak of inflation by year-end looks a good chance, not the least as that is what will likely happen in most countries. Reduced supply-chain concerns and weaker domestic and global demand will be the drivers of lower price growth. This will be partially offset by higher wage costs (and rising rents). Treasury currently has a higher CPI forecast than me for the following year. Given the weather and geo-political issues, that is reasonable. There is not expected to be any real wages growth until 2023-24.

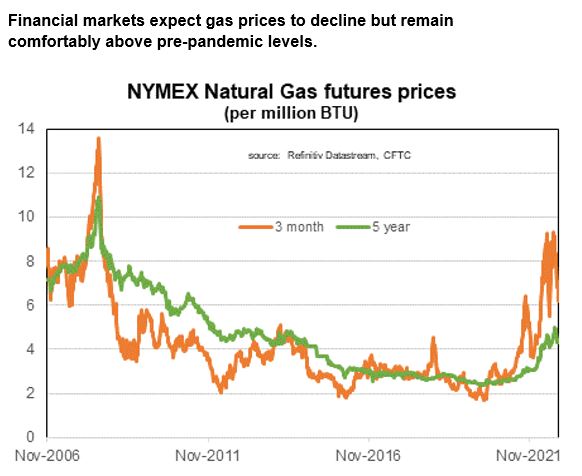

One reason why the Budget is in better shape than predicted earlier in the year is that prices for key commodity exports have been higher than forecast. As would be expected the Treasury is projecting a substantial drop for most commodity prices. That is reasonable. The risks to the forecast are balanced in the near term. There is the likelihood that the global economy will be weaker than is currently expected (and commodity prices lower). But ongoing weather and geo-political problems could cause more supply problems and result in higher prices. In the longer term, changing geo-politics and under investment is likely to lead to structurally higher commodity prices (particularly for energy).

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist