Economic and Financial Market Update: Another step higher

Summary:

- The RBA surprisingly increased the cash rate by a quarter percentage point following its May meeting, taking the cash rate to 3.85%;

- The RBA said further rate hikes are possible;

- While inflation is above 3% the only cash rate movement can be up;

- Household spending and the global economy were the two main risks nominated by the RBA.

What the RBA decided

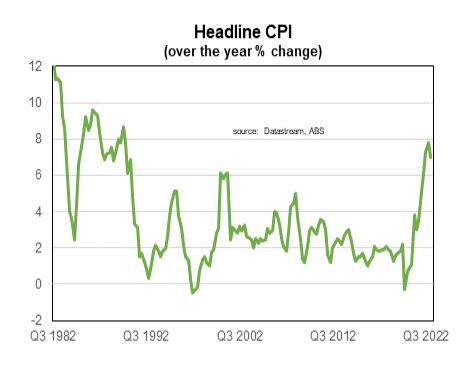

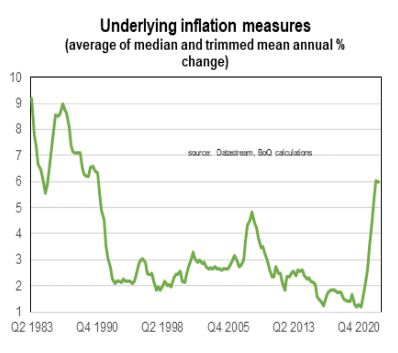

The RBA surprisingly increased the cash rate following its May meeting. While economists did expect another quarter percentage point rate rise, they did not think it would take place until the following quarter. Clearly what is playing on the RBA’s mind is that the inflation rate is currently around 7%, well above its stated target. The monthly CPI figures indicate that inflation is declining but at only a moderate pace.

While noting that goods inflation is falling, the RBA noted the strength of service prices as well as the sticky pace of underlying inflation in other economies. The $A has traded ‘soggy’ in recent weeks, partly a result of expectations that the peak of the RBA cash rate would be at or below that of peer countries. And a lower $A makes it harder for the RBA to keep inflation low.

The RBA nominated as its key uncertainty, consumer spending. Disposable incomes are being hit by the higher cost of living, rising interest rates as well as the previous decline in house prices. Some households are already making tough financial decisions, others have the benefit from significant saving.

The RBA noted that the world economy is a source of uncertainty. That is true given the uncertainty of how the recent banking sector problems may impact the global economy. More generally, the economic data has been surprisingly strong in many economies for much of this year. The aggressive rise of interest rates in a number of economies is likely to (in time) result in weaker economic outcomes.

The RBA did not reference the recent rise in house prices. Maybe that is because the April rise in house prices occurred too late to form a basis of analysis at this meeting. It is also possible that the RBA hasn’t formed a strong view as to why house prices have gone up and so therefore think it is too early to call the bottom of the market.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist