Economic and Financial Market Update: As good as it gets

Summary:

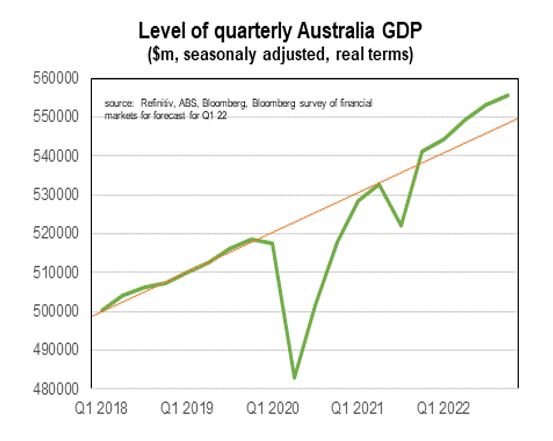

- GDP grew by 0.5% in Q4, weaker than I had anticipated;

- Other indicators suggest the economy was performing better than that GDP figure at the end of last year;

- Outlook for economic growth should be decent in the current half year but be below par in the 2023-24 financial year;

- Wages growth remains low and is not a driver of the current inflation rate.

We found out recently that GDP grew by 0.5% in the December quarter. This was the slowest pace of growth since September quarter 2021, a time when both Sydney and Melbourne were in COVID lockdown. That pace is a little under the average quarterly growth rate of 0.6%.

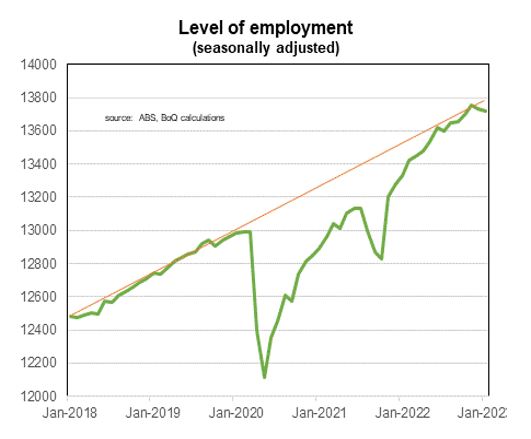

Slowing in the pace of economic growth is consistent with the wider evidence. The growth of credit, new orders, job vacancies and retail trade (adjusted for inflation) all took a step down in the December quarter. The unemployment rate was reported to have risen. The slowing in economic momentum was put down to rising cost of living and increasing interest rates. Flooding played a role. Worker and material shortages acted to constrain the growth rate (and push up inflation).

But I think the economy was doing better than the reported growth rate. The pace of new orders slowed but remained above its long-term average. Worker shortages remained firms’ biggest constraint, the lack of orders was far less of a concern for most. Household spending grew strongest in discretionary areas such as recreation and accommodation and food services. Capex intentions remain firm.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist