Economic and Financial Market Update: First, reach the peak

Summary:

- The RBA kept the cash rate at 4.1% following its August meeting;

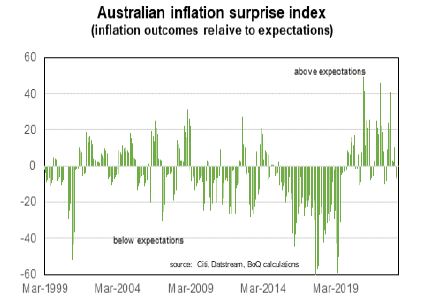

- The lower-than-expected June quarter CPI data would have been a key factor behind that decision;

- The pace of the decline of inflation will be the key question behind any further rate hikes, particularly the behaviour of service-sector prices;

- I think the risks are that inflation may again surprise on the high side some time over the next 3-6 months and that will be the catalyst for another rate rise.

RBA interest rate decision

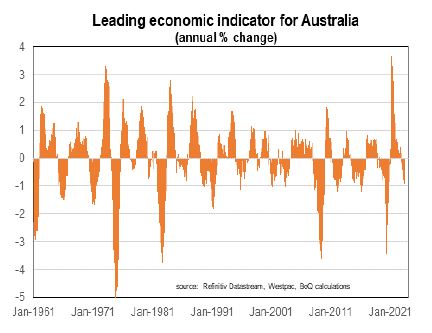

The RBA decided to keep the cash rate unchanged at its August meeting at 4.1%. The economy is slowing pretty much in line with RBA expectations from May, and so is inflation (despite the lower-than-expected CPI outcome in June). Given that we have yet to see the full impact of the past rate hikes an unchanged rate decision this meeting was sensible.

The RBA is projecting that the inflation rate will return to within the 2-3% target band by the end 2025, with an unemployment rate of around 4.5% by the end of next year. If those forecasts remain unchanged, and the certainty around those forecasts don’t change, the RBA may not increase rates again. On the RBA’s forecasts, rate cuts would have to wait until 2025 (later than current financial market pricing).

The key question though is how certain can the RBA be that inflation returns back to 2-3% within the foreseeable future. The RBA noted the risks around service-sector inflation, and that the current annual rate of the CPI at around 6% is too high. This means if there is to be a rate change any time over the next 6 months it will be a rate hike.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist