Economic and Financial Market Update: Rate rethink

Summary:

- The RBA has made it clear that there are further rate hikes to come;

- I expect that the next quarter percentage point rate hike will be in March;

- And I now expect that there will be a further quarter percentage point rate hike in May;

- I don’t think a cash rate of 3.85% will cause a sharp decline in the economy;

- But we can’t be certain how the economy will react as interest rates head higher.

Updated cash rate view

Before the Feb meeting I was at one with the consensus. There would be a rate hike in Feb, with another rise to be delivered at one of the following couple of Board meetings (I thought in April).

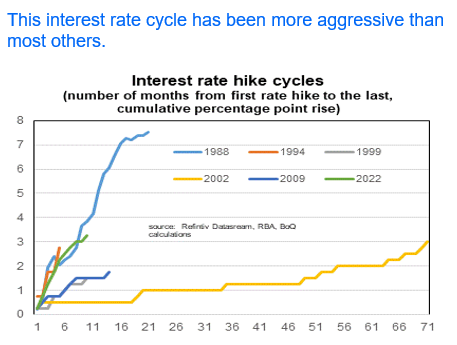

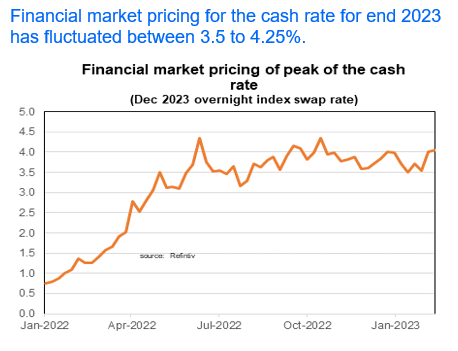

The Statement post the meeting though was more aggressive on the potential for more rate hikes than I (or most others) had expected. The Q4 inflation number would have been a key factor in the change in view by the RBA although more optimism about the short-term global economic outlook may have played a role. Recognizing the shift in tone following the meeting, I moved forward my forecast on the timing of the next rate hike to March. I kept the peak in the cash rate at 3.6%. Financial markets though moved even further, shifting from pricing in one more 25bp rate hike to pricing in three more 25bp hikes.

The RBA subsequently released its Monetary Policy Statement (MPS) that gave more detail about its forecasts. The MPS did not make it clear (at least to me) as to why the RBA had become more aggressive. A better hint came from the Governor’s testimony before the Senate when he noted the big price rises in parts of the CPI (such as travel) he largely attributed to strong demand.

I am not sure that is correct. The big rise in airplane fares (for example) was down to both very strong demand and reduced number of flights. He also mentioned that Australia has not benefitted from the decline of good prices to the same degree as other countries (such as the US). But I think that is largely because that the Australian economic cycle is behind that of other countries as we re-opened our economy from COVID later. I do agree with the RBA that strong demand has driven one-quarter to onethird of the rise of inflation.

In both the Statement following the decision and the MPS was the very prominent sentence, “the RBA expects that further increases in interest rates will be needed over the months ahead…”. Noting the plural, most market economists appear to have shifted their view of the peak in the cash rate to at least 3.85% (some are higher). I have joined the 3.85% group. And the stated likelihood of more than one rate hike means a peak in the cash rate of 4.1% is more likely than 3.6%.

I still think 3.6% peak in the cash rate will be enough to get inflation back to target. My thinking was (and remains) that the shift up in the cash rate has been both large and quick, enough (together with the reduction in supply-chain problems) to get inflation back under control. The RBA clearly thinks the inflation risks are higher and believe a higher cash rate will be necessary.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist