Economic and Financial Market Update: Budget - Back in black (briefly)

Summary:

- As foreshadowed, the underlying budget is likely to be in surplus in the 2023 financial year;

- A deficit of $14b is projected for next financial year, below what had been forecast in October;

- This means that fiscal policy will have a modest additional impact on the economy in the coming financial year;

- A bigger budget surplus would have helped reduce inflation risks although there are many factors that influence the inflation outlook;

- There are good equity grounds for there to be fiscal support to low-income earners at a time of high inflation;

- The medium-term fiscal challenge of how to deal with higher spending demands;

- The lower debt starting point provides the Government more space in dealing with the challenge;

- An improvement in productivity growth would simplify the fiscal outlook.

Short-term economic outlook – Weaker economy in 2023-24

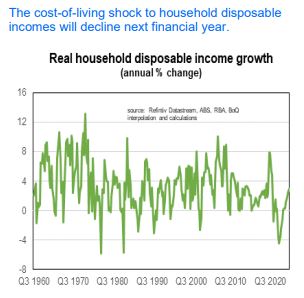

The main forecasts are pretty much as expected and close to those released by the RBA in its May Monetary Policy Statement. Economic growth is expected to slow this financial year before picking up the following financial year as households real disposable income (disposable income after allowing for inflation) growth improves. The weaker economy will see a modest rise in the unemployment rate that will hit 4.25% by mid next year and peak around the end of next year. Inflation will slow from its current rate of 7% to a bit over 3% by mid next year. Wages growth is expected to rise only modestly further. Business investment is forecast to slow but remain positive (higher inflation means more capex spending gets less).

A big decline is expected in the terms of trade (i.e., commodity prices are expected to decline substantially) next financial year by over 13% and over 8% the following year. This is not quite as sudden a decline as assumed in October (a factor that has helped the budget forecast). Treasury changed its methodology from assuming a quick move back to the assumed long run value of the terms of trade to using financial market pricing. I agree with the updated approach.

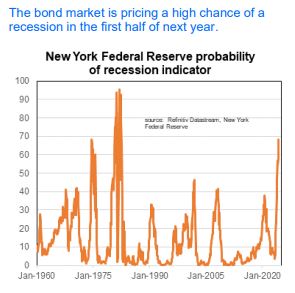

I also agree that the economy will slow this year, although I have a weaker outlook in 2025 than what Treasury is currently forecasting. One reason for the difference is that I think economic growth will be at its weakest in the first half of next year, where as Treasury is likely assuming the low point is the second half of calendar 2023. Consumer income growth is likely to be in excess of inflation by early 2024, boosting household spending power, but after having rundown their saving this year I think it more likely that households will spend time rebuilding their saving buffer. Households are also likely to remain cautious if interest rates remain where they are (or head higher). I am not expecting any rate cuts until the second half of next year.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist