Economic Update: Choosing the Cash Rate path

Summary:

- The RBA cash rate was kept unchanged at 4.1%;

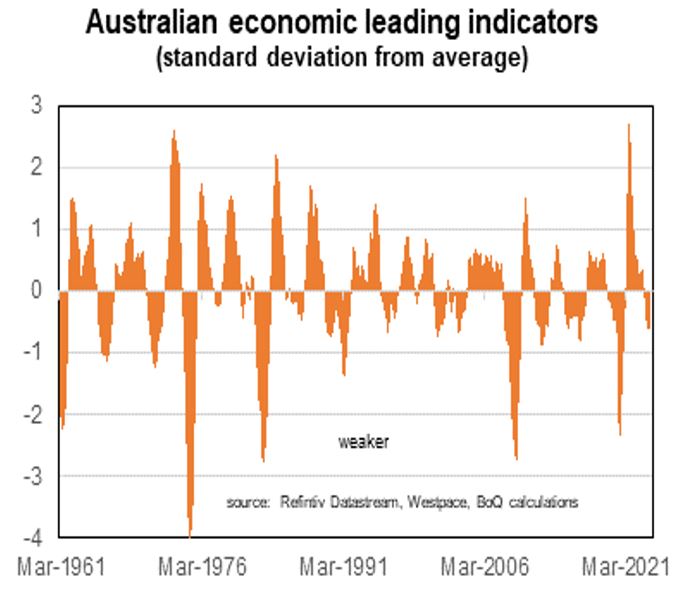

- This was expected given the weaker economic and lower inflation data that has printed in the past month;

- The domestic and global economic inflation outlook remains uncertain;

- I still think that some inflation data will surprise with strength in coming months and this will lead to one more quarter percentage point rate hike before year-end.

The RBA kept the cash rate unchanged

The RBA kept the cash rate at 4.1% following its September meeting. That was widely expected amongst economists and the financial markets. The economic data has been weaker than expected and inflation lower over the past month.

The RBA appears broadly comfortable with economic and inflation developments, still forecasting that inflation returns back towards the 2-3% target by the end of 2025. The current level of inflation means they clearly retain a bias to increase the cash rate although recent developments on the inflation front would mean they are more relaxed than they would have been three months ago. The RBA is aware that interest rates have risen very quickly over the past year, and that the full impact of higher rates has yet to hit the economy.

The RBA nominated four risks to the outlook. One is that service-price inflation has remained too high in a number of countries and that could be the case in Australia. Another is that it’s difficult to know what firms will decide with their price and wage decisions given the combination of a slowing economy, a very low unemployment rate and above-target inflation. The outlook for consumer spending remains uncertain given that some households are feeling the squeeze from the high cost of living while others have the income and saving buffers to keep spending. Finally, the outlook for the Chinese economy is uncertain.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist