Economic update: Inflation down but not by far enough

Key points:

- The Q3 CPI data surprised on the high side;

- Inflation is declining but not as quickly as the RBA was hoping;

- The cash rate in Australia is about one percentage point below that of peer countries;

- All of this makes it likely that the cash rate will rise by a further quarter percentage point at the November RBA meeting.

The inflation number was higher than expected

Some economic numbers mean more than others and that was the case with the Q3 CPI data. The RBA had recently made it clear that it was getting uncomfortable that inflation might stay too high for too long.

The essence of the message was that if inflation continued to decline in line (or below) the RBA’s forecasts then the cash rate may have peaked. But if inflation surprised notably on the high side then another rate hike was likely. The September quarter CPI data surprised on the high side.

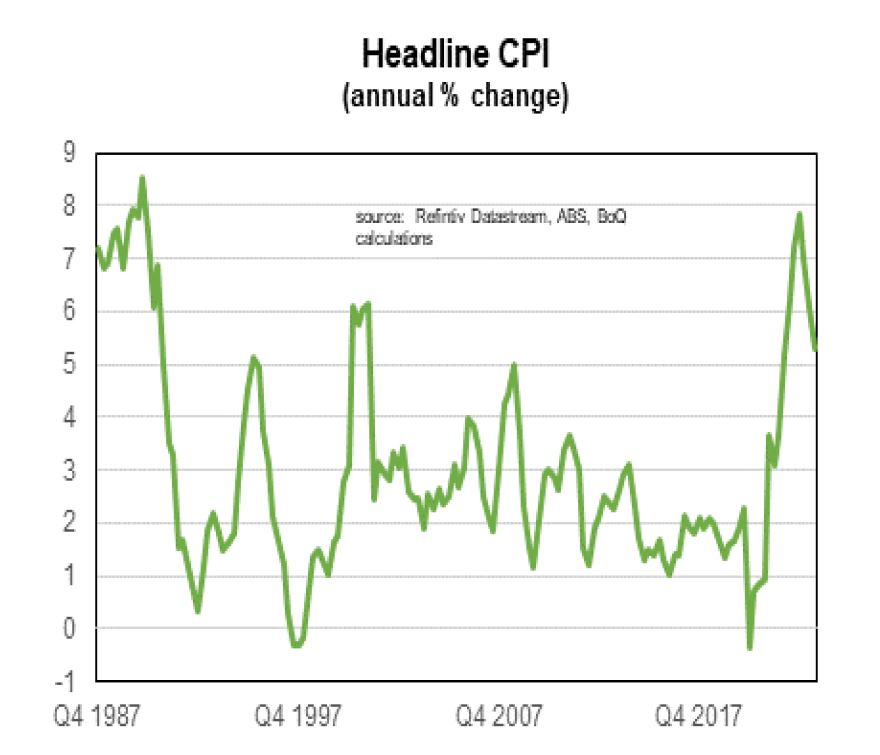

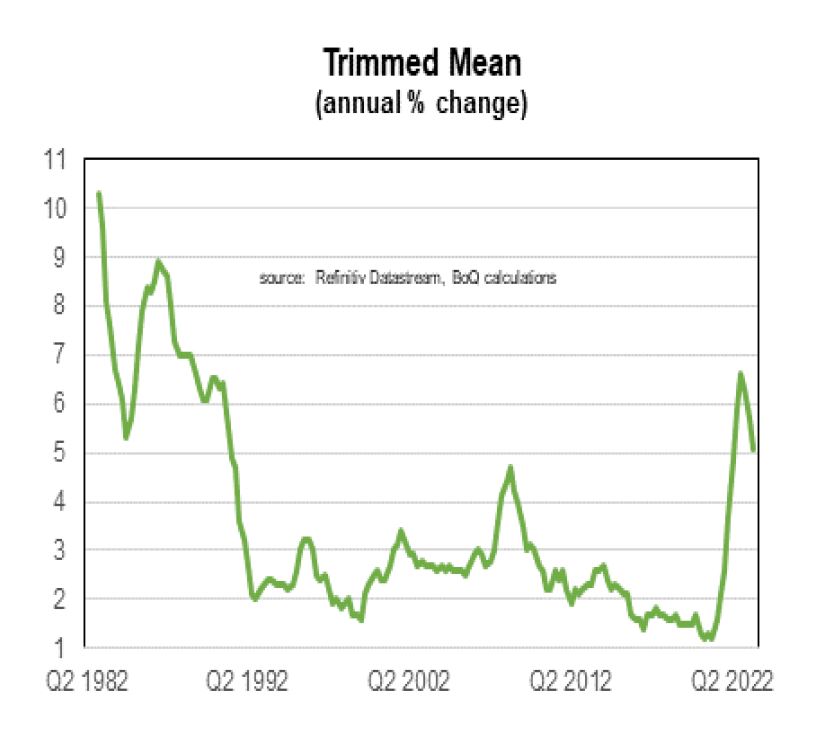

The headline CPI rose by 1.2% in the September quarter (5.4% over the year). The RBA also likes to look at alternative gauges of inflation. It’s favourite measure of ‘underlying’ inflation is the Trimmed Mean which also rose 1.2% in the quarter (up 5.2% over the year).

It was not all bad news. The growth in goods prices (removing the volatile items) continues to slow and services inflation might have started to fall. Tradeable goods continues to decline in line with ongoing improvement in global supply-chain problems. on-tradeable goods and service inflation appears to have peaked. All of this suggests that further slowing in the inflation rate in coming quarters is likely. For example, the experience of the US suggests that furniture inflation in Australia is likely to slow further (and could decline) in coming months.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist