Economic Update: The jobs market – Stronger for longer - Part 2

Summary:

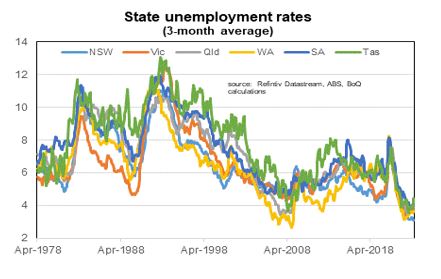

- The unemployment rate is currently near fifty-year lows;

- But it has been lower historically;

- Australia’s participation rate is at a record high and it will likely head higher;

- There are signs of an increase in skill-mismatch in the jobs market.

The jobs market has been strong

The Australian Government recently released an employment White Paper. In one respect talking about employment growth in the current economic environment was strange timing. The unemployment rate is close to fifty-year lows and the biggest issue that firms currently face is difficulty finding workers. Households are more challenged by the cost of living than concerns about high unemployment.

There was some discussion that the paper is inconsistent with the RBA’s (and Federal Treasury) view that the unemployment rate will need to rise to get inflation back to the RBA’s 2-3% target band. It is not. The aim of the paper is essentially how to get a higher proportion of the population in work while keeping inflation consistent with the RBA’s target.

In any event, the RBA’s view on a rise in the unemployment is a forecast of what they think will occur to get the inflation rate back to 2-3%. But I do not read it as a pre-condition. In other words, I am sure the RBA would be very happy if inflation can return back to 2-3% while the unemployment rate remains near its current level.

In this note I am not going to comment on any of the suggested policy changes from the White Paper. On face value many of the suggested policies appear reasonable although the devil (as always) will be in the detail. History demonstrates that the most important thing that can be done to generate jobs growth is to have strong (non-inflationary) economic growth. Instead, this note will look at the areas where a potential boost to the number of job holders could occur, something the White Paper did a decent job of highlighting.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist