Economic and Financial Market Update: More to be done

Summary:

- The Q3 wages growth number was strong, as was the October jobs number;

- Neither of those outcomes is a major surprise given the current state of the economy;

- The RBA is on track to deliver another quarter percentage point rate hike in December;

- After a pause in January, the RBA is likely to deliver two more quarter percentage point hikes in H1 2023, taking the cash rate to 3.6%.

Wages

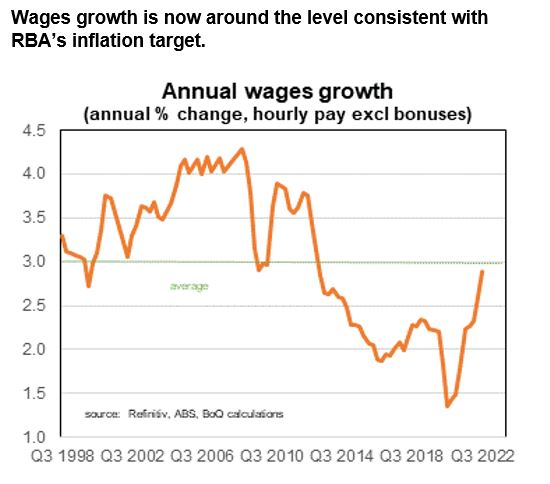

For the first time in years a wages number came in higher than expected. The ‘surprise’ though wasn’t much of a surprise given the strength of the jobs market and inflation. In one respect the bigger surprise was that wages growth hasn’t been higher earlier. The headline wages number is now around the 3% mark that the RBA had been looking to achieve.

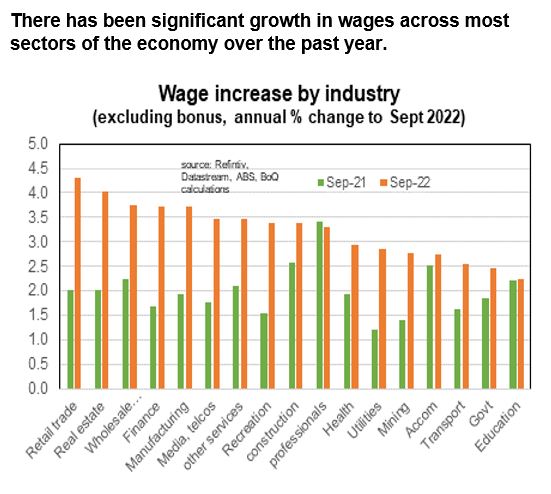

The headline number understates the strength of wages growth. Private-sector wages growth (more sensitive to changes in the economy) is stronger than that for public-sector wages. Wages growth once bonuses are added are now over 4% in the private sector. The proportion of workers that have had to wait less than a year for a pay rise is higher now than in pre-pandemic times.

Wages growth has risen strongly across almost all sectors of the economy over the past year. It is now above 3% in around two-thirds of industries, and above 3.5% in five. The recent pay rise granted in the national wage case played a role in stronger wages growth. Pay rises for workers on individual agreements played a bigger role.

The jobs market is likely to remain strong for at least another year. We are likely close to the peak of inflation although most forecasters don’t expect the CPI to go below 3% until at least sometime in 2024. Public-sector wage growth will likely be stronger. This suggests that aggregate wages growth has further to rise.

A further strengthening of wages growth should not be a concern. We are near the cyclical peak in inflation, and the jobs market strength is likely to peak around the middle of next year. This means that wages growth should moderate over the course of 2024 if the RBA (and other forecasters) are right in their view that the unemployment rate will rise and inflation rate will decline.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist