Economic and Financial Market Update: The end game

Summary:

- The RBA hiked rates by another quarter percentage point (taking the cash rate to 3.1%) following its December Board meeting;

- The statement released post the meeting indicated that further rate hikes are likely;

- The RBA now has 2 months before the next meeting to see how the economy is absorbing higher interest rates and negative real wages growth;

- The economy will be in good enough shape and inflation high enough to see another couple of rate hikes in 2023 (I expect the peak in the cash rate to be 3.6%);

- The timing of any reduction in the cash rate is likely to be a 2024 story.

As was widely expected the RBA raised the cash rate by 0.25% following its December meeting. The level of the cash rate (3.1%) is now at its highest level in over 10 years (November 2012).

There was some speculation prior to the meeting that the RBA might not move the cash rate. Both the October CPI and retail sales numbers were lower than expected. And there is concern about what rising interest rates might do to an indebted household sector. But the RBA noted that the economy is doing well, the jobs market is tight, wages growth is rising, and that inflation is too high.

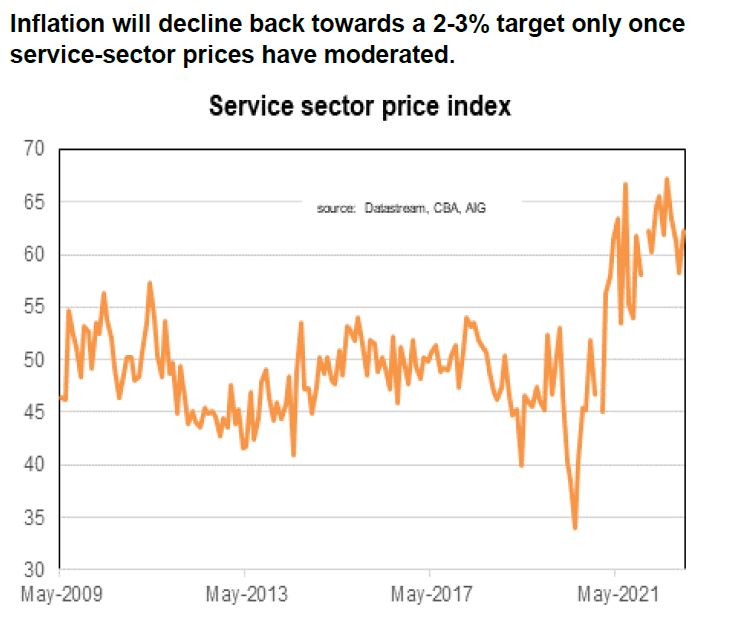

In a statement released after meeting, the RBA indicated that there is likely to be further rate hikes. We are near the inflation peak although the likelihood of higher electricity and gas prices means substantially lower inflation may yet be months in the distance. Generally, the Australian economy ended 2022 on strong footing although there are segments of the population already feeling the pinch of higher inflation and rising housing costs (both for rents and mortgages).

The widespread view that the economy will weaken once the Xmas holiday ends is reasonable, although at this stage it remains a forecast not an outcome. The high level of job vacancies (the RBA noted that there has been some reduction in demand for labour in recent months) means the job market will remain tight for at least the next couple of quarters. A tight labour market means wages growth will be heading higher. The cash rate can no longer be described as low. But at 3.1% nor can it be described as unusually high relative to either Australia’s interest rate history in the low-inflation era or the current level of the cash rate for international peers.

The RBA now has 9 weeks before its next scheduled meeting. Over that time a couple of job reports and the quarterly CPI data (in addition to two monthly inflation reads) will be released. This is in addition to a host of other information (such as the growing array of business and consumer surveys). In all likelihood the data will still show an economy in decent shape. This could be the first ‘normal’ festive season in the Eastern States in 4 years (bushfires in 2019, COVID the past two years) and that might mean consumer spending will be solid over the Xmas break. Inflation will still be too high and the jobs market tight. The global economy would have slowed further although global central banks will have increased interest rates further, still worried about the inflation outlook.

That background suggests a further rate hike in the New Year. I have another 0.25 percentage point hike pencilled in for February. The RBA expects economic growth to slow next year, and I agree. The combination of a weaker global economy, declining house prices, negative real wages growth and rising interest rates will act as a drag on the Australian economy. The RBA may pause to gauge how the economy is going, particularly with what is happening with inflation. The lesson from other economies that re-opened after COVID before Australia is that the slowing of economic momentum is more gradual than rapid. So, with inflation still well above target, the economy doing Ok and wages growth rising, I think there will be one final rate hike in April/May.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist