Economic and Financial Market Update: The hike continues

Summary:

- The RBA increased the cash rate by 0.25 percentage point following its October meeting (taking the cash rate to 2.6%);

- Financial markets weren’t surprised by the need for a rate rise, however, were surprised by the magnitude (they were expecting 0.5 percentage points);

- The RBA highlighted that further rate hikes are on the way;

- I think the cash rate will peak around 3.5% in this cycle, below current financial-market projections.

As widely anticipated, the RBA hiked rates following its October meeting. The arguments for a rate hike are generally agreed. The big surprise for most analysts today was that the rate hike was ‘only’ a quarter percentage point (BOQ was one of the few banks that got the magnitude of the move right this month). The immediate financial market reaction was what you would expect with the RBA hiking rates less in a world of aggressive central bank actions: the $A declined.

We will see where the $A goes in coming days. The main reason the currency is trading so low against the $US is the strength of the $US. With signs that the US economy is slowing and that the Federal Reserve may not be increasing interest rates as aggressively as previously anticipated there is an argument that the $A may increase in coming months.

I think the reduced size of the rate hike is a reflection of a couple of factors. First, the underlying inflation problems (wage growth, commodity prices) is of less a concern in Australia than it is in other countries. Second, an understanding that the high level of debt owed by Australian households makes them potentially sensitive to rising interest rates. How sensitive, in a world of extraordinary labour market strength, is an important question.

The RBA noted that while the domestic economy is still performing well enough, the risks to the global economic outlook have risen. All three of the major economic regions (US, China and Europe) are all now clearly slowing. There have been promising signs that inflation in the US will slow further in coming months. How much the global economy and inflation declines, is another crucial question.

The RBA made it clear, that it believes the cash rate will need to rise further. Strong demand means that the cash rate should be at least towards the upper end of the so-called neutral range (2.5-3.5%). At the time of writing, financial markets were pricing a peak in the cash rate of close to 4% by mid next year. Views about the peak cash rate have evolved over the past six months between 3.5-4.5% in line with changing views regarding the economic and inflation outlook and the likely global central banks’ response. As the global economy slows, I would expect financial markets views on the peak of the cash rate to decline towards the bottom end of their range.

For me that means that the peak in the cash rate in this cycle will be around 3.5%. The economy is very strong, the labour market will remain robust for some months to come, and the inflation rate is high and not forecast to peak for another 3-6 months. Smaller rate moves by the RBA provides them with the option of stopping earlier if the economy weakens or if inflation slows a lot faster than they are currently thinking. The RBA has almost twice as many meetings as most other central banks. Proving the opportunity to increase cash rates in smaller amounts than other central banks.

Demand vs supply

One of the questions I have been asked by clients over the past few weeks is why the RBA is so keen to hike rates when much of the inflation is due to supply-side problems that can’t be fixed with monetary policy. The RBA has been asked the same question, notably in Phil Lowe’s recent appearance before Parliament.

This supply v demand question is one that is being asked globally. The evidence of how much the rise of inflation has been driven by demand or supply varies across countries. For example, it is widely considered that demand is playing a bigger role in driving up inflation in the US (studies say between one-third to 60%) than in, Europe.

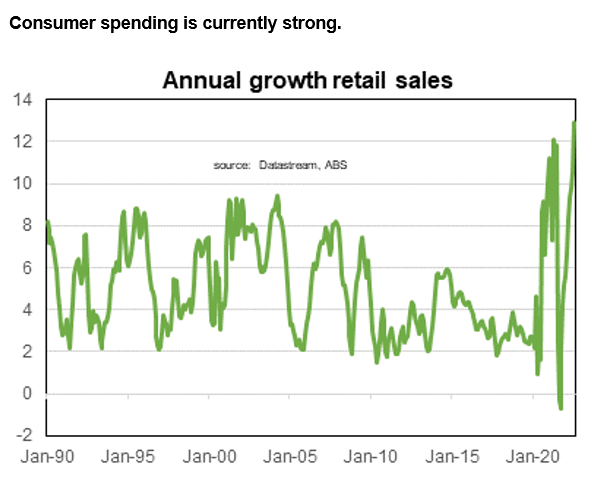

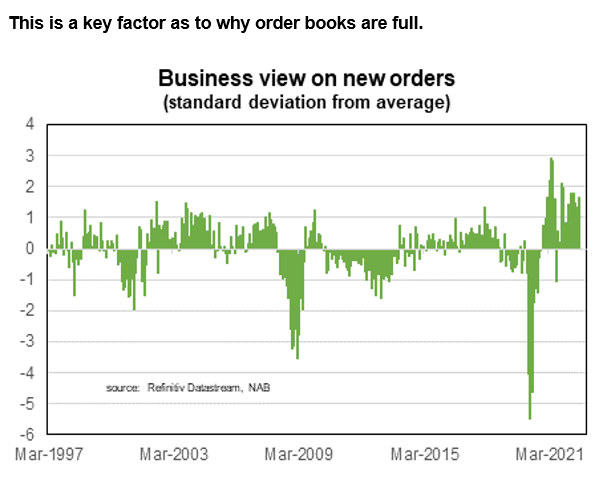

There is no doubt that demand has played an important role in driving inflation higher in Australia. Economic growth is now above its pre-pandemic growth path. Despite weak sentiment, consumer spending remains robust as highlighted by strong retail sales. Strong spending means firms remain keen to hold more inventories and need to increase their capex spending. All of this has meant that many firms’ order books are looking pretty stacked. Indeed, their number one concern remains the difficulty in recruiting workers.

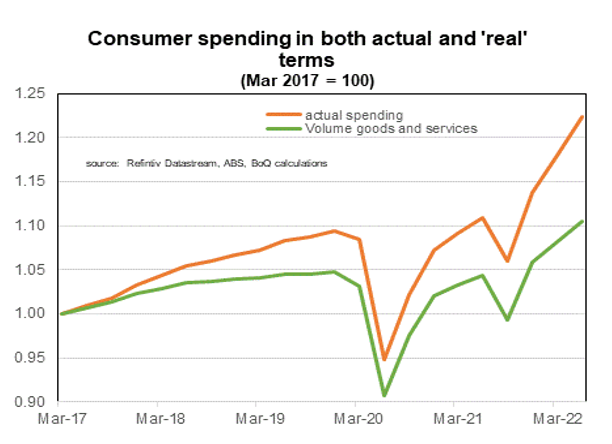

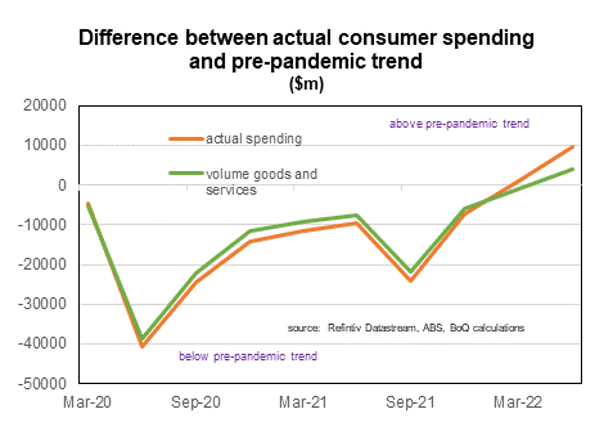

One approximation in determining how much the rise in prices is down to stronger demand is to look at how much household spending has grown over the pandemic and how much of that is a result of buying a higher volume of goods and services and how much is down to higher prices (that potentially could be more driven by supply problems). To isolate how much the pandemic has changed things I have used the difference between how much has actually been spent (in both volume and actual spending terms) versus how much would have been spent if household spending had been maintained in line with its pre-pandemic trend.

In the early part of the pandemic both total spending and volume of goods bought declined at the same pace. Over the next year the volume of goods, outpaced the rise in total spending. This reflected both the pickup in spending due to decent income growth as well as discounts offered by firms (particularly in the services sector).

But this year actual spending has notably outpaced the volume of goods purchased reflecting the significant rise in prices. By my estimation total spending on goods and services was around $9.5b higher in the June quarter relative to its pre-pandemic trend. Of that extra spending about 40% reflected the purchase of higher volumes of goods and services. This proportion of higher spending due to increased volumes is lower than usual and a reflection of the supply-driven response in many prices.

This means that although supply problems are the likely main driver of higher inflation in Australia, demand has played a significant role. Some easing in goods demand will happen naturally, not the least reflecting the number of new homes that are being completed (which generates demand for household goods such as furniture), However, demand is strong enough to require a higher level of interest rates.

To read my full update, click here.

We live in interesting times.

Regards,

Peter Munckton - Chief Economist