Fast Track Starter Account

Our youth savings account for 14-24 year olds

This account is no longer available for sale to both new and existing customers from 1st April 2025.

Learn about Future Saver Account

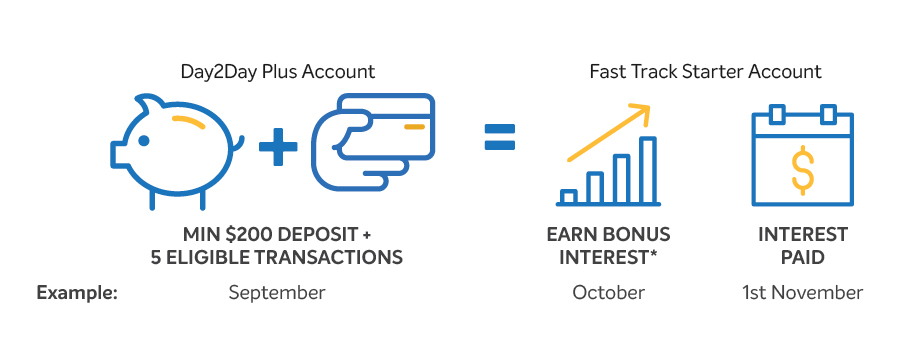

Here's how you can earn your Bonus Interest with our Fast Track Starter Account.

Awarded Rate City’s Gold Award 2021 for Best Savings Account Young Adults

Our Fast Track Starter Account is literally a winner. We're proud to announce our Fast Track Starter Account was recently awarded the 2021 Rate City Gold Award for Best Savings Account Young Adults - making it the ideal account for 14-24 year olds looking to save.

When it comes to savings, we keep our fees to a minimum & rates to a max! Any fees we do have we’ll show you up front so there are no surprises.

| Balance | Base + Bonus Interest variable rate % p.a.* | Base variable rate % p.a. |

|---|---|---|

| $1 to $10,000 | 2.75 |

0.05 |

| $10,000.01 to $250,000 | 2.25 |

0.05 |

Interest rates are variable rates and are subject to change at any time without notice. Interest is calculated daily on a stepped basis and paid monthly on the first day of the following month.

| Features | Applicable Fees |

|---|---|

| Account Maintenance Fee | Nil |

A full list of fees can be found in our Fees and Charges Guide.

Everyday banking with no monthly account keeping fees

Our simple, intuitive everyday transaction account, made even better for you with user-friendly features that help you make the most of your money.

earn q rewards® points and enjoy Travel Perks

The Platinum rewards card that has you covered, from purchases to rewards alongside our everyday earn rate of 2 Q Rewards® Points earned on every dollar of eligible spend.4 Including complimentary insurance and extended warranties (terms, conditions, limits and exclusions apply).1

Note: complimentary travel insurances will no longer be available from 15 May 2026. Find out more here.

BONUS INTEREST VARIABLE RATE FOR BALANCES UP TO $250,000 IF BONUS INTEREST CRITERIA MET**

Our high interest savings account for customers 36 years or older.