Delivering a gold standard of banking

At BOQ, we’re dedicated to delivering a customer experience that’s of a gold medal standard. And like any champion will tell you, a lot of time and effort goes into producing best performance. So whether it’s the in-branch face-to-face experience, or using the new myBOQ app, we want every customer to walk away from the interaction feeling like you’re getting your personal best from BOQ.

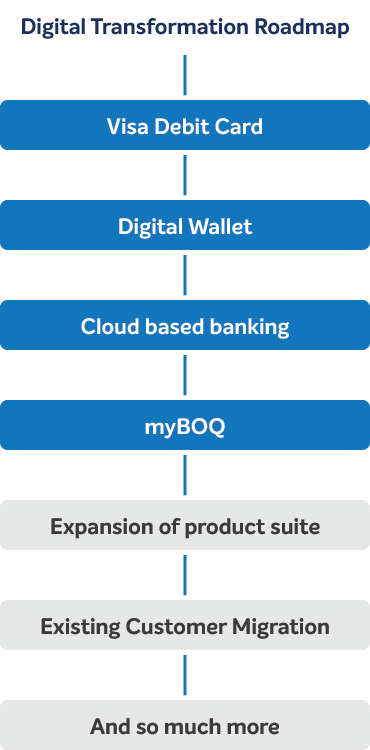

myBOQ app rollout: A relay, not a sprint

Our app rollout is being completed in stages. Now that we’ve launched the platform and got it up and running, we’re busy making plans to move you over and introduce new products to the app. We’re really sweating things now to get everything working seamlessly for the main event.

Up next

Get poised to dive in

The resulting app experience will be something we’re really proud of delivering to you – and we can’t wait for you to dive in and take a look around. And the best part? The app is only the beginning of what other great developments we have in store for you.

myBOQ makes managing your money easier than ever

Download the myBOQ app!

Getting started is easy. Open and use your account in minutes.

Check your eligibility

You will need:

- To be aged over 14

- To be the account holder (applications cannot be completed and submitted by an Executor/Administrator/Power of Attorney/ Legal representative)

- An Australian residential address

- An Australian drivers licence or Australian passport

- An Australian mobile number

- A smartphone that supports iOS 12.0+ or Android 8.0+