Open your

Future Saver

account

Why choose a Future Saver account?

Plus, a linked transaction account for effortless everyday banking.

Not only does the Future Saver account come with our highest bonus interest savings rate, but it also comes automatically linked with an Everyday Account. It’s the perfect match to help you manage your money.

Win an exclusive Red Bull Symphonic experience

Thanks to Visa, new and existing BOQ Everyday Account customers have the chance to win an exclusive travel package valued at $5,000 for two adults to attend Red Bull Symphonic in Sydney, featuring Ruel, May 16th - 18th.4

Enjoy next-level banking with myBOQ

Our Future Saver accounts are on the myBOQ banking app. They’re bundled with an Everyday Account so you can manage all your finances in one place.

Things you should know

- myBOQ is our mobile app with exclusive app-only accounts like Future Saver and your Everyday Account. That means you can't access app-only accounts via Online Banking.

- If you hold other bank accounts with us that you access via Online Banking, you won't be able to get into those accounts within the myBOQ app.

Our highest bonus interest

savings account

Future Saver accounts have three tiers or levels of interest rates, with the highest tier offering the highest savings interest rate that we offer.

| Balances up to | Base Rate % p.a. | Bonus Rate % p.a. | Highest Rate % p.a.** |

|---|---|---|---|

| $0 to $50,000 | 0.05% | 5.20% | 5.25% |

| $50,000 to $250,000 | 0.05% | 2.70% | 2.75% |

| $250,000 + | 0.05% | 0.00% | 0.05% |

Interest rates are variable rates and are subject to change at any time without notice. We calculate your interest daily and pay the total into your savings account on the first day of the following month.

Important Information

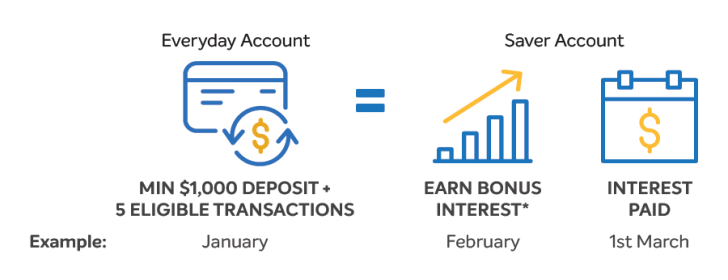

- Bonus Interest Rate will only apply for each calendar month when the bonus interest criteria is met in the previous calendar month. If the bonus interest criteria is not met, your account will earn the Base Rate.

- The Future Saver Account will automatically convert to a Smart Saver Account on the date you turn 36 years old.

Here’s how you can score our highest savings rate

Take two steps to earn our bonus interest rate with Future Saver:

Note for new customers: To help you get started on reaching your savings goals, you'll start earning bonus interest as soon as you open your Future Saver Account. Then to continue earning monthly bonus interest rates you'll need to meet the above bonus interest criteria.

If you're aged between 14 -17 years of age, we'll waive the bonus interest criteria, so you'll earn bonus interest every month on your Future Saver balance as shown in the table.

Fees and Charges

Please see the myBOQ Deposit Account Interest Rates, Transaction Limits, Fees and Charges document for more details.

Ready to apply for your high-interest Future Saver account?

- Grab your phone and scan the QR code

- Download the myBOQ app

- Apply for your savings account

|

And if you'd rather apply for your accounts online, that's easy too.

Before you apply for the Future Saver

You will need:

- To be aged between 14 years old and 35 years old

- To be the account holder (applications cannot be completed and submitted by an Executor/Administrator/Power of Attorney/ Legal representative).

- An Australian residential address

- An Australian drivers licence or Australian passport

- An Australian mobile number

- A smartphone that supports iOS 14.0+ or Android 8.0+.

Important Documents

- TMD - Future Saver

- myBOQ Deposit Accounts General Terms and Conditions

- myBOQ Deposit Accounts General Terms and Conditions (Effective 10 May 2025)

- myBOQ Deposit Account Interest Rates, Transaction Limits, Fees and Charges

- myBOQ Deposit Account Interest Rates, Transaction Limits, Fees and Charges (Effective 10 May 2025)

FAQs

Explore more savings and transaction accounts:

Everyday banking with no monthly account keeping fees

Everyday Account

Our simple, intuitive everyday transaction account, made even better for you with user-friendly features that help you make the most of your money.

- Access your money whenever you need, exclusively on myBOQ mobile app. Please note: As an app-exclusive account, it cannot be accessed via Internet Banking.

- Managing your money has never been easier, with in-app spend tracking to help you budget better and bill tracker to give you a heads up when bills are due.

- Fast, easy payments. Pay or be paid instantly with PayID.

- Open an Everyday Account directly within the myBOQ app and start banking with BOQ today!

GET A GREAT, ONGOING INTEREST RATE FOR BALANCES UP TO $5 MILLION

Simple Saver Account

No hoops and no fuss when you just want to save. Simply sit back and watch your savings grow.

- Available on the myBOQ app

- No monthly account fees

- Grow your savings with no minimum deposit

- Simply sit back and watch your savings grow